While technological disruption is a significant force in the long-wave business cycle, there’s an even larger wave at play: the rise and fall of global empires. Much like business cycles, this grander wave also significantly impacts businesses. We are observing the transition of power and influence from one dominant empire (the United States) to another (China). This shift in global dynamics presents unique challenges and opportunities for businesses operating within this broader geopolitical context.

The Cycle of Collapse: Fate of Empires

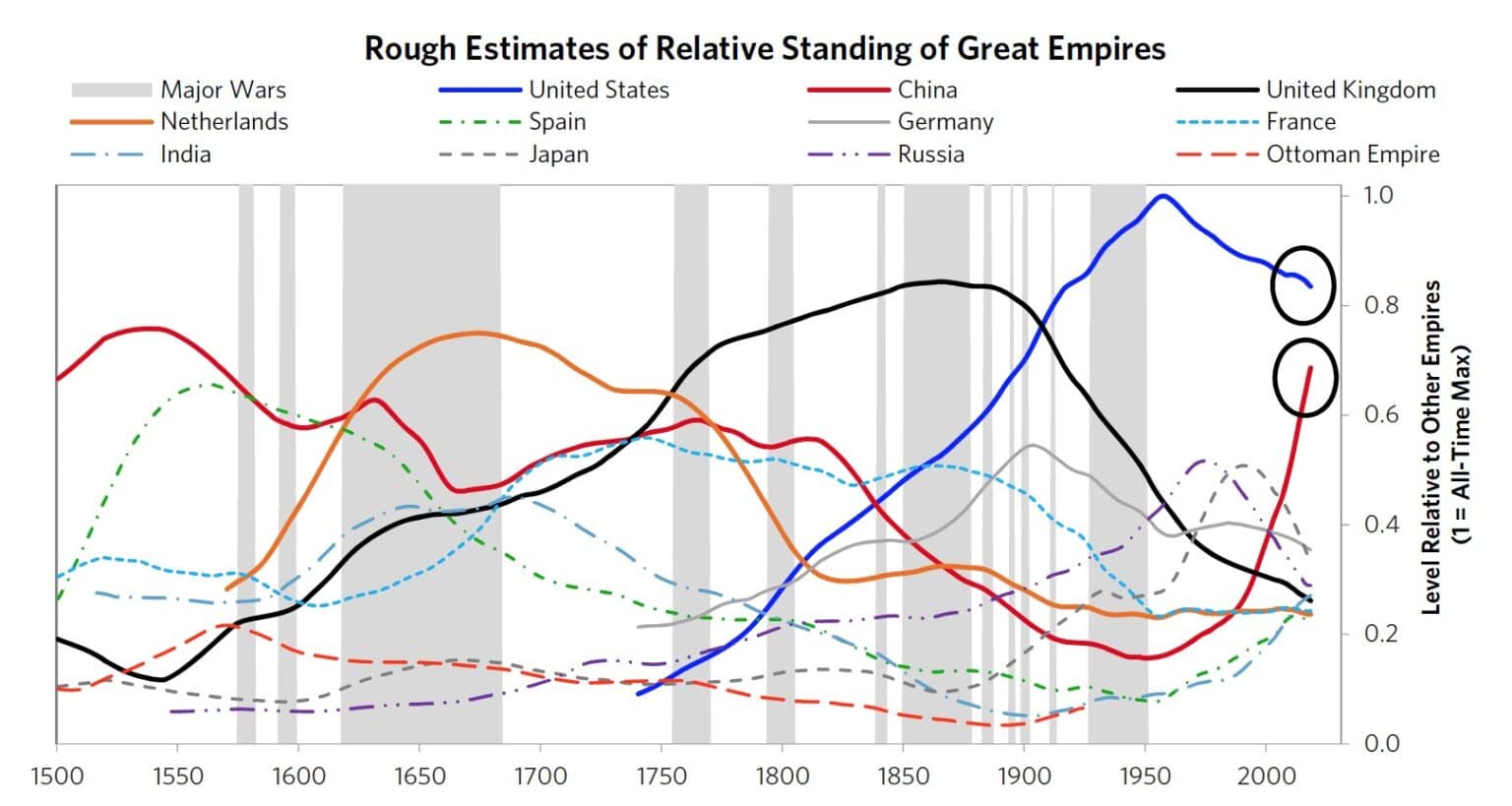

The documentary “Four Horsemen” by Renegade Economics (2011) delves into the patterns of rise and decline in human history as studied by Sir John Glubb in “The Cycle of Collapse: Fate of Empires.” Glubb’s research spans 4,000 years of human institutions, uncovering striking similarities across various empires despite diverse climates, cultures, and religions. A key illustration in the documentary is a graph comparing the relative standings of great empires, notably highlighting the steady decline of the United States and the exponential rise of China, emphasizing the cyclic nature of empires.

One of Glubb’s findings was that empires rise and fall, on average, over 250 years, equal to some ten generations. He found that he could break down each cycle into 6/7 stages:

- The Age of Pioneers (Outburst)

- The Age of Conquest

- The Age of Commerce

- The Age of Affluence

- The Age of Intellect

- The Age of Decadence

- The Age of Decline/Collapse

The Four Horsemen documentary suggests that the USA has transitioned through the Age of Decadence and is entering the Age of Decline. The following two decades (2020-2040) could be chaotic if true.

Can We Afford to Ignore These Signs?

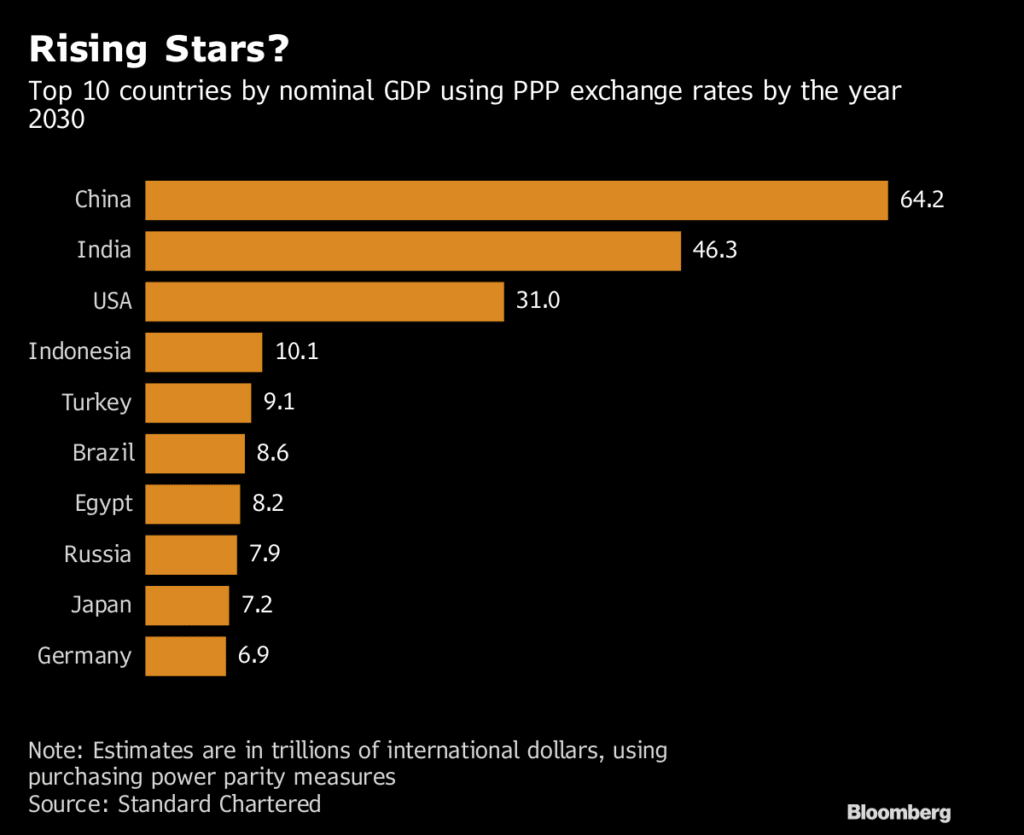

Since 2009, China has emerged as the world’s largest exporter of goods, experiencing a substantial 196% growth in GDP from 2008 to 2018. Although still behind the USA in GDP as of 2021, China’s economic trajectory suggests that by 2030, using purchasing power parity (PPP), it might catch up and potentially double the US’s economic output. This rapid growth could significantly enhance China’s financial capabilities, potentially allowing it to become a formidable global force economically and militarily. India is also projected to make substantial gains, possibly surpassing the USA.

Considerations

- Commodity Access: What would be the impact if China restricted access to vital commodities?

- Geopolitical Actions: How would China potentially invading Taiwan affect global stability and relations?

- Europe’s Position: What does this shift mean for Europe’s role and strategy?

- Business Impact: How might these changes affect the purchasing power and bargaining strength of businesses?

- Trade Dynamics: What implications could there be for export volumes to regions under China’s influence?

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS-SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts