Summary of this post: Mastering the intricacies of longwave business cycles, known as Kondratieff waves, is essential for optimal business positioning and forward strategizing and crucial in identifying and mitigating inherent risks. These cycles, discovered by Nikolai Kondratieff and spanning an average of 53 years, reveal patterns of growth and decline in capitalist economies.

By comprehending these cyclical patterns, businesses can better navigate the ebbs and flows of economic conditions, ensuring sustainability and competitive advantage in a dynamic capitalist environment.

Insights into Longwave Business Cycles and Economic Growth

Mastering business conditions is crucial for strategic positioning and risk assessment, and one valuable perspective is understanding the business cycle.

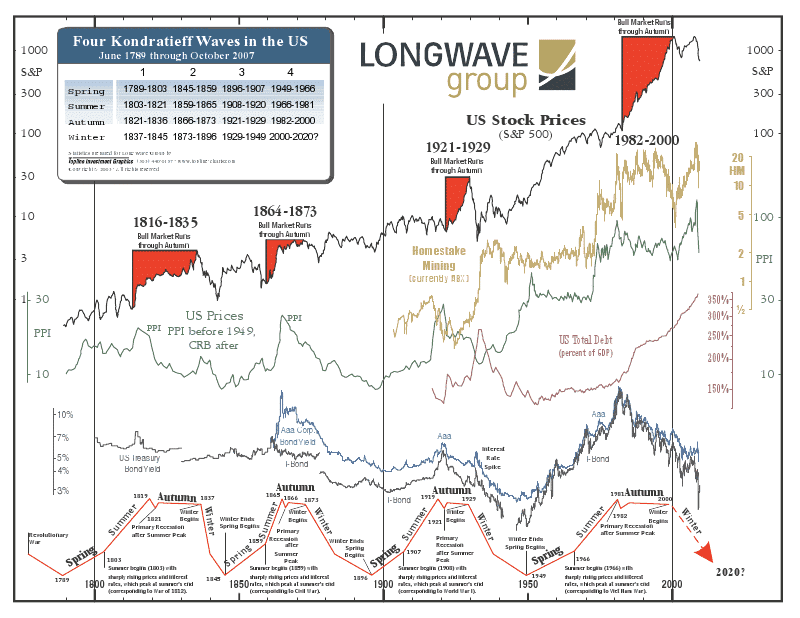

A decade ago, our accountant introduced us to longwave business cycles, or Kondratieff waves, which repeat roughly every 53 years. These cycles, characterized by alternating periods of growth and decline, were first analyzed by Nikolai Kondratieff, who sought to compare economic patterns in capitalism and socialism. Despite political opposition, Kondratieff’s findings highlighted capitalist economies’ resilience and growth potential, offering vital insights for understanding long-term economic trends.

The following figure shows the indexes Kondratieff used to construct his longwave theory, among which the S&P500 Index, US Producer Price Index (PPI), CRB Commodity Index, Homestake Mining Company (Gold price, longest-listed stock at the NYSE), and the US Debt-to-GDP.

Business Cycles and Technological Revolutions

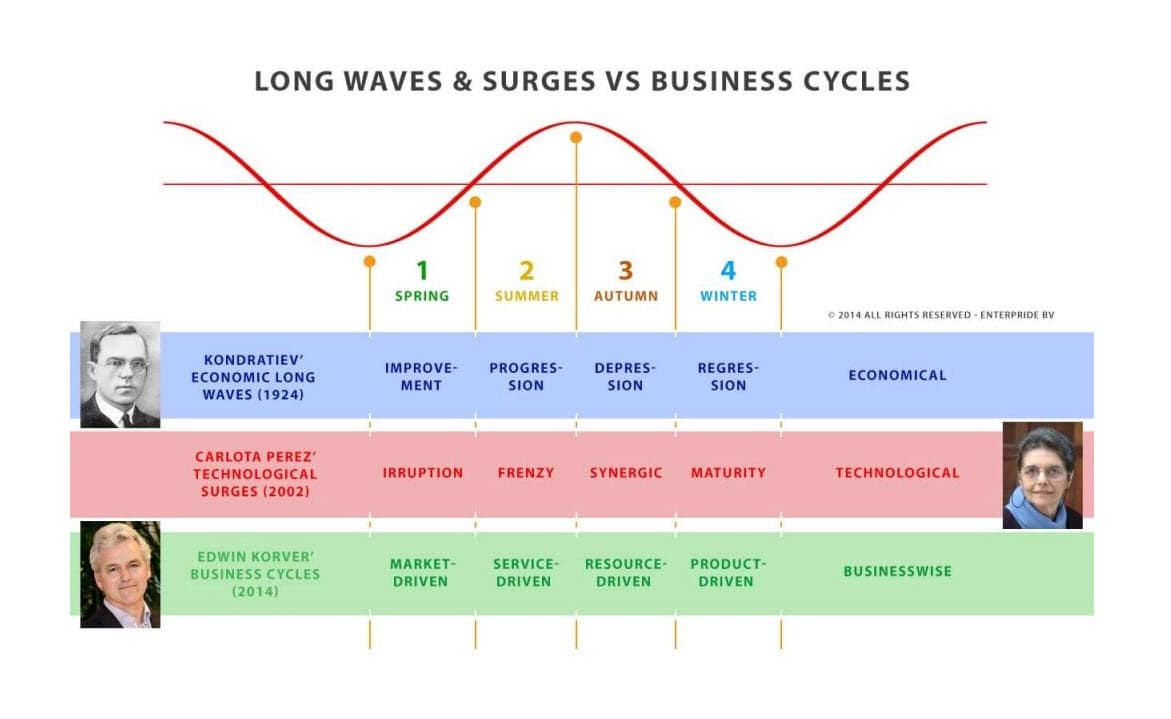

In her 2002 book, “Technological Revolutions and Financial Capital,” Carlota Perez linked significant technological advancements to Kondratieff waves, affirming Joseph Schumpeter’s concept of creative destruction and the notion that technology drives economic growth. Schumpeter highlighted how technological progress enhances the efficiency and quality of goods and services, fostering prosperity. He also named these cycles ‘K-waves’ in honor of Kondratieff’s pioneering work, underscoring the vital role of technological innovation in shaping economic trends and transformations.

Preparing for a Keynote Presentation in 2014

Edwin Korver pondered how companies move along these long-wave business cycles while preparing a keynote presentation for Social Media Week 2014 in Rotterdam.

At the beginning of his career, Edwin had read the book In Search of Excellence (1982) by McKinsey’s consultants Peters and Waterman. In hindsight, he found proof for his hypothesis in the book’s final chapters.

In their work, Peters and Waterman highlighted that ‘excellent’ organizations outperform peers by effectively unlearning outdated habits and reevaluating their corporate purpose. They emphasized the importance of early testing of product-market combinations through prototyping, minimizing cost and risk.

Notably, companies like Proctor & Gamble stood out for encouraging teams to innovate, even if it meant disrupting their existing products. This approach allowed for continual adaptation and improvement, vital for maintaining a competitive edge in dynamic markets.

The insights he gained from “In Search of Excellence” aligned closely with the principles of LEAN startups, a concept popularized much later. Steve Blank’s “The Four Steps to the Epiphany” and Eric Ries’s “The LEAN Startup,” although published decades after the McKinsey bestseller, echo similar strategies. Considering that many Silicon Valley startup founders and employees originated from these ‘excellent’ companies, it’s not surprising they adopted similar cost-effective and low-risk market entry strategies, demonstrating the enduring influence of these early business principles.

How Business Dynamics Evolve Throughout the Cycle

In his keynote, he explored how business dynamics vary across different business cycle stages, pondering whether our responses have evolved alongside technological changes.

Historically, as farmers for most of the past 10,000 years, people developed habits rooted in seasonality and superstition to ensure successful yields, aligning with Einstein’s notion that repeating the same actions typically yields the same results.

In contrast, today’s industrial age rewards those who proactively innovate and disrupt their product cycles. However, considering our evolutionary past, this shift poses a challenge, as evidenced by research like John Kotter’s, which indicates a 70% failure rate in corporate transformations. Change is often resisted unless perceived as a clear improvement to our lives.

The Keynote Presentation

After further deliberation, he presented the following slide at Social Media Week, broadcasted internationally:

He argued that businesses, as they pass through the long-wave business cycle, can be categorized into four primary driver systems:

- Market-driven – Market preferences determine favorable technologies and business models.

- Service-driven – Post-technology stabilization, focusing on service excellence.

- Resource-driven – Market saturation, focusing on operational excellence.

- Product-driven – Abandoning existing product cycles in favor of product and market innovation.

While these categories are questionable, they offer a realistic framework for understanding business strategies in response to economic cycles.

Long-Waves, Surges and Business Lifecycles

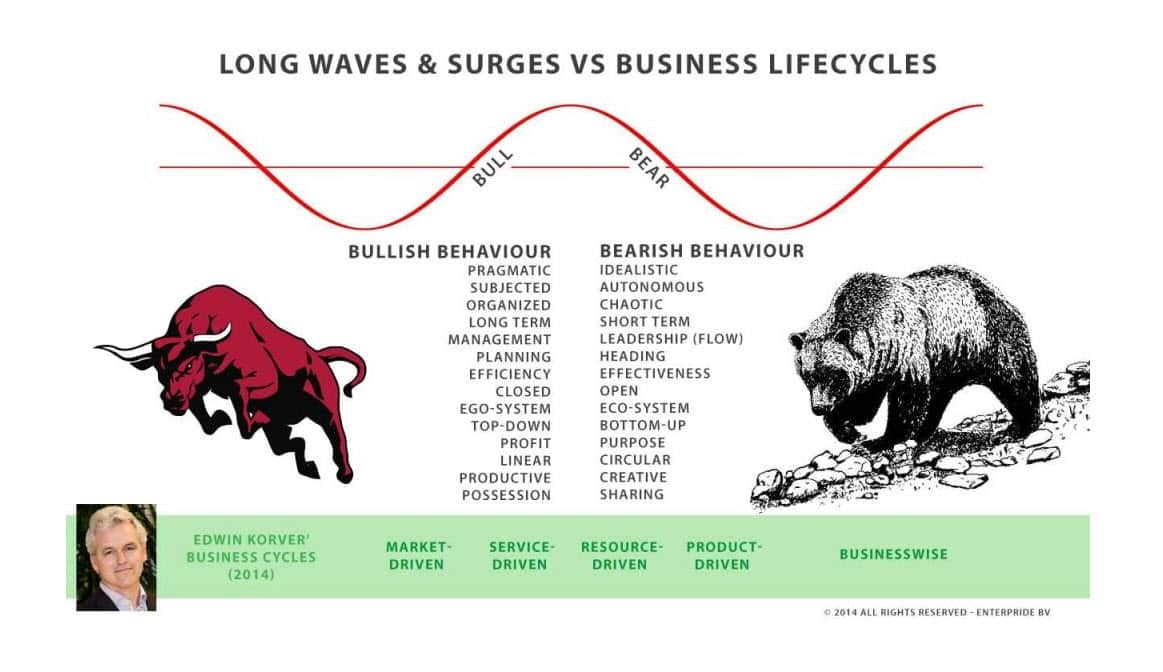

During the presentation, I added a few characteristics of the growth (bull) and decline (bear) stages of the business cycle:

The four stages can also be described as product-market innovation, product-service innovation, product-service optimization, and product-market optimization. These four stages match the typical pattern of the product lifecycle, i.e., Introduction, Growth, Maturity, and Decline.

![Conditional Mastery: Getting a Firm Grip on Business Cycles 5 Product-Life-Cycle-Stages-1024x5731-1-600x336[1]](https://roundmap.com/wp-content/uploads/Product-Life-Cycle-Stages-1024x5731-1-600x3361-1.jpg)

From Top (Peak) to Bottom (Trough)

I’ve realized that understanding the distinct dynamics at different points in the longwave business cycle, particularly the peak and trough, is crucial today as we near the bottom of the fifth K-wave. To delve deeper into this topic, I’ve written a blog post titled “Ascending from Decline,” which discusses strategies for adapting to the current economic challenges. Reading this blog will provide valuable insights into navigating the complexities of this phase of the cycle. You can find more information in the blog post.

Mastering Conditional Growth

The concept that business dynamics must adapt to the varying phases of the business cycle is central to what I call Conditional Leadership. This involves mastering growth throughout each phase of the cycle. As a business cycle concludes, signaling the end of the technologies that emerged at its start, executives face the critical task of foreseeing potential early declines in their products and actively seeking new growth opportunities to secure the future of their business. This proactive adaptation at the cycle’s end is crucial for long-term sustainability and success.

Although the figure above may suggest that mastering Conditional Growth is entirely related to longwave business cycles, it is not. Conditional Growth relates to every cyclical event, condition, or circumstance a company is part of or exposed to.

Effectively growing a business requires a deep understanding of its position within various business cycles, necessitating a wide-ranging perspective. A lack of comprehensive insight can lead a company to make numerous missteps: developing products or entering markets that don’t align with consumer needs, attracting the wrong customer base, clinging to an unrealistic vision, choosing impractical strategies, falling prey to savvier competitors, misallocating valuable resources, and recruiting unsuitable talent. These misjudgments can significantly hinder a firm’s potential for success and growth.

PS. A PESTLE analysis, STEEPLE analysis, Porter’s Five Forces, 5C analysis, VRIO analysis, SWOT analysis, or SOSTAC framework could help determine potential growth gaps and constraints.

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM

![Conditional Mastery: Getting a Firm Grip on Business Cycles 2 Diagram_Kondratieff_wave[1]](https://roundmap.com/wp-content/uploads/Diagram_Kondratieff_wave1.png)

![Conditional Mastery: Getting a Firm Grip on Business Cycles 6 ROUNDMAP_Slide_Mastering_Business_Cycles_Copyright_Protected_2021[1]](https://roundmap.com/wp-content/uploads/ROUNDMAP_Slide_Mastering_Business_Cycles_Copyright_Protected_20211-1024x683.png)