A compelling contrast emerged as we delved deeper into the complexities and nuances of the RoundMap framework. As I had known them, traditional businesses were rooted in what I would later discern as ‘as-a-product’ business models. They seemed to be playing a familiar tune, employing well-established frameworks.

On the other hand, a new breed of competitors, particularly those wielding the power of digital technology, were breaking the mold. They weren’t simply offering products but services, engaging in what I realized were ‘as-a-service’ business models.

This begs several intriguing questions: Are these emerging business models revolutionary creations of our time or just new iterations of old concepts? How can they be categorized? What distinguishes them from traditional models? And most importantly, what is the secret sauce behind their sustainable growth?

Definitions

First, let’s have a look at the definitions of a business model:

- Investopedia: A business model is a company’s profit plan. It identifies the products or services the business will sell, the target market it has identified, and the expenses it anticipates.

- Wikipedia: A business model describes the rationale of how an organization creates, delivers, and captures value in economic, social, cultural, or other contexts. The business model construction and modification process is called business model innovation and is part of business strategy.

- Our version: A business model serves as the architectural blueprint of an organization, detailing not only how it achieves financial viability but also how it creates a symbiotic relationship among its stakeholders—employees, customers, shareholders, and society at large. It outlines the pathways through which the organization generates revenue and distributes value in a manner that enhances collective well-being and individual self-esteem.

Business Model Matrix™

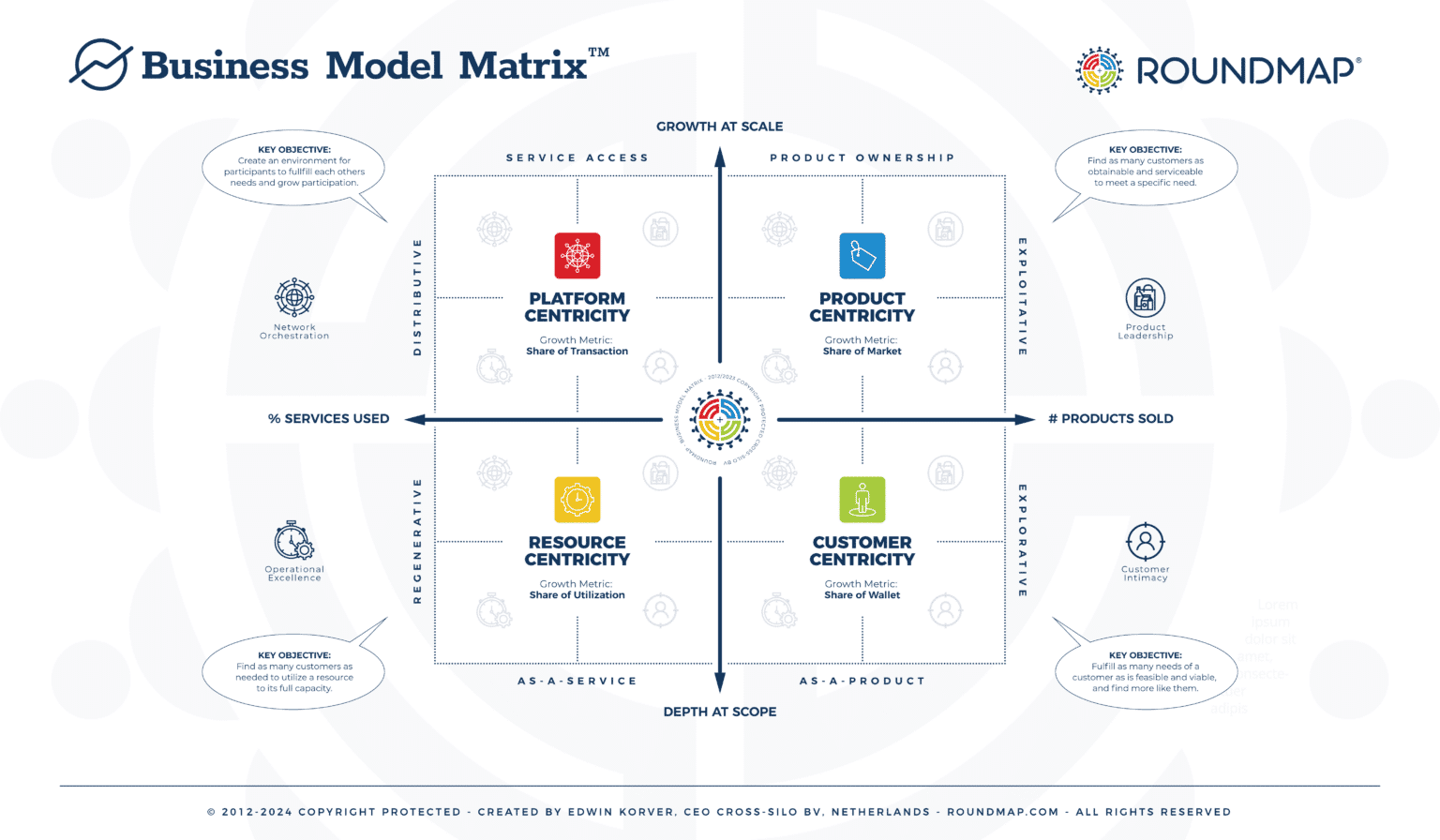

Now, let’s have a peek at the (revised) Business Model Matrix:

A Matrix of Growth Objectives and Strategic Choices

Picture a strategic canvas that not only decodes the DNA of your business model but also aligns it with your grand vision and unlocks pathways to untapped opportunities.

This is the Business Model Matrix. You have the spectrum of your offerings on one axis, ranging from on-demand services to an arsenal of products. On the other, you have your strategic ambition—from explosive growth at scale to unmatched depth and scope in your sector.

The matrix presents you with four magnetic quadrants—each a crucible for a distinct yet powerful business model:

- First, Product-centricity: This is where you’re the gladiator in the market arena, wielding your products as weapons of choice. It’s a competitive, even confrontational, model where growth is powered by product innovation and market conquest.

- Next, Customer-centricity: Here, you’re not just a seller but a trusted partner, a confidant. You operate in a ‘comparative’ mode, customizing your approach to resonate with each customer deeply. The focus is not just on transactions but on transformative customer relationships.

- Shift your gaze to Resource-centricity and find yourself in the ‘as-a-service’ domain. This is the ‘compositive’ realm, where every resource—be it time, talent, or technology—is optimized to its fullest, fueling an engine of efficiency and utility.

- Last but not least, Platform-centricity: This is the collaborative frontier. You’re not just in business; you’re orchestrating a dynamic ecosystem. This quadrant is rooted in symbiosis, believing that power and opportunities are not zero-sum but expandable to benefit all participants.

And as if these four strategic epicenters weren’t compelling enough, each can be tailored further through one of four value positions: Product Leadership, Customer Intimacy, Operational Excellence, and our unique addition, Network Orchestration. That translates into 16 individual pathways carving your route to market supremacy.

The Business Model Matrix is not just a diagnostic tool; it’s a strategic compass pointing you toward untapped terrains and unparalleled success.

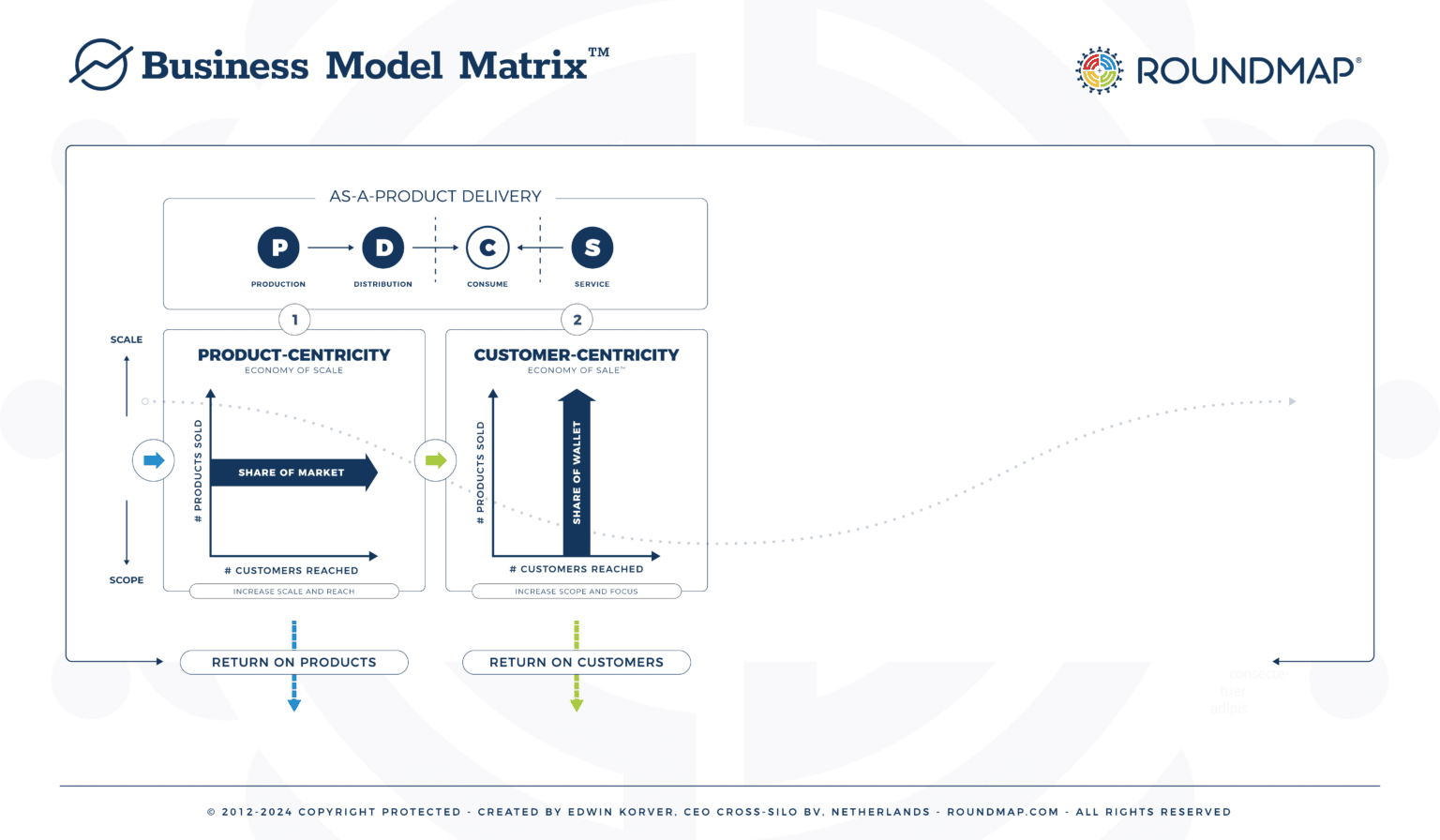

Two As-a-Product Value Delivery Models

Navigating Between Product-Centricity and Customer-Centricity

A suitable business model is increasingly critical for achieving sustainable success in the evolving business landscape. The as-a-product value delivery models are foundational approaches that have shaped industries for years. Specifically, product-centricity emphasizes the product’s development, quality, and delivery as the central value proposition. On the other hand, customer-centricity places the customer at the core of every decision, aiming to tailor experiences and offerings to meet individual needs and preferences.

Though they take diverging routes, both models aim to create tangible value through the product offered or the customer experience. Understanding these models is crucial for any organization striving for differentiation and competitiveness in a crowded market.

Don Peppers, author, and co-founder of Peppers & Rogers Group, provided a description for product-centricity:

Product-centric competition is based on having a product that meets a specific customer need and then trying to find as many customers as possible who want that need to be met. The number of customers reached measures success. In competitive terms, this would represent a share of the market.

While also offering one for customer-centricity:

Customer-centric competition starts with an individual customer and tries to meet as many of that customer’s needs as possible – across all the company’s divisions and business units and through time. In competitive terms, this would represent a share of the wallet.

The Exploitative Nature of Product-Centricity: Driving Growth Through Market Saturation

In the Business Model Matrix, we’ve coined the term ‘exploitative’ to encapsulate the defining characteristics of product-centricity. Positioned along our vertical axis, this business model aims to capitalize on the full breadth of market potential, targeting the total addressable market. The objective here is clear: growth at scale. Achieving such a scale often involves comprehensive and relentless marketing campaigns that blanket consumer consciousness.

Consider companies like Apple, Procter & Gamble, and Coca-Cola. These giants don’t merely exist in the market; they define it. Apple’s iPhones, MacBooks, Procter & Gamble’s myriad consumer goods, and Coca-Cola’s beverages are not tailored for niche markets. Still, they are designed to penetrate and dominate large, diverse market segments. It’s worth noting that such market omnipresence isn’t merely a byproduct of success; it’s the objective. For these organizations, scale isn’t just advantageous; it’s imperative. Hence, most traditional businesses align with this product-centric mode, seeking to establish market leadership through widespread recognition and adoption of their products.

The Explorative Essence of Customer-Centricity: Deepening Relationships for Wallet Share

In contrast to the broad strokes of product-centric models, customer-centricity thrives on an ‘explorative’ approach, diving deep into the nuanced landscape of individual customer needs. Let’s be clear: this model transcends mere customer satisfaction. While marketing casts a wide net to address issues felt by a broader audience, the sales aspect of this model cultivates one-on-one relationships, guiding customers toward well-informed decisions. This isn’t about mass appeal but understanding specific needs and tailoring solutions accordingly.

Think of it as a bespoke service in a world of off-the-rack options. In traditional parlance, strategies like account-based marketing or account management are pivotal in meeting these individualized customer needs. Take, for instance, companies like Intuit with its personalized financial solutions, IBM’s tailored technology services, Amazon’s user-centric algorithms, Capital One’s customizable credit offerings, and Harrah’s individualized customer rewards. These companies exemplify the essence of customer-centricity: not just serving the market but understanding and adapting to the complexities of individual consumer needs. In competitive terms, they are vying for not just a market share but a more lucrative share of each customer’s wallet.

The Dual Pillars of As-a-Product Value Delivery: Exploiting Markets and Exploring Customers

These distinct but interrelated models—product-centricity and customer-centricity—fall under the umbrella of ‘As-a-Product’ operating frameworks. What unites them is a focus on driving customers toward an act of purchase that grants them some form of ownership or possession. They are about acquiring and claiming—either a share of the market or a share of the individual customer’s wallet.

Situated on the right-hand side of the Business Model Matrix, these models correspond directly to the acquisition component or demand side within the broader RoundMap framework. Essentially, they are the driving forces that fuel customer acquisition, each with its unique strategy and scale or scope of operation.

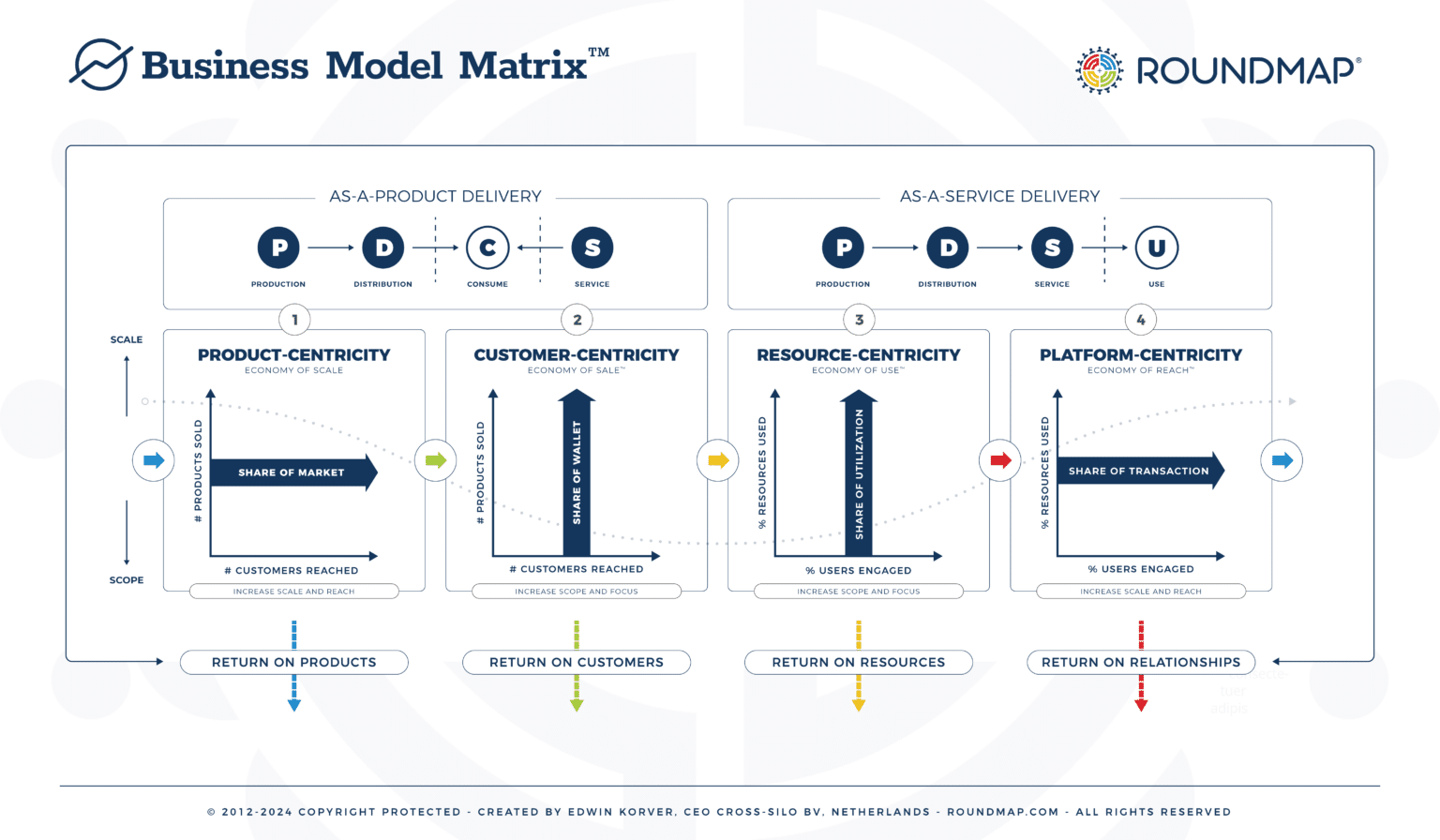

Two As-a-Service Value Delivery Models

Navigating Between Resource-Centricity and Platform-Centricity

As the customer acquisition landscape intensifies, becoming both challenging and costly, organizational focus is increasingly pivoting toward customer retention. Parallel to this shift is the digital revolution, transforming competitive paradigms from traditional as-a-product to more agile as-a-service delivery models.

It became clear that existing frameworks fell short of encapsulating these conventional and emerging models. Against the backdrop of popular buzzwords like the Sharing Economy, Resource Economy, Servitization, Uberization, and the Network Economy, I felt compelled to delve into these ‘new-age’ business models.

My inquiry led to an intriguing revelation: These novel as-a-service models could be perfectly mapped onto the retention side (and supply side) of the RoundMap framework. I identified two distinct variations: platform-centricity, which is growth-driven, and resource-centricity, focusing on in-depth engagement.

I had to introduce another dimension to crystallize these observations into a cohesive matrix. The horizontal axis was designed to feature ‘Percentage of Services Used’ on the left and ‘Number of Products Sold’ on the right. And thus, the Business Model Matrix™ was born.

The Circular Potential of Resource-Centricity: A Regenerative Approach to Value

Resource-centricity is inherently ‘Regenerative,’ focusing on the intelligent syndication of supply into a resource-based service offering. This model aims to maximize utilization rather than mere ownership. Take airlines, for instance: the primary goal is to sell tickets and fill each flight to capacity. It’s not about selling more tickets than there are seats; it’s about optimizing the use of each plane to its fullest potential. The same philosophy drives ride-sharing services like Greenwheels, where the objective is not the car itself but the optimized utilization of each vehicle in the fleet.

While resource sharing might seem contemporary, it’s a practice as old as civilization. We’ve shared trains, airplanes, buildings, and theaters for centuries. What has changed is the advent of digital technologies, notably the internet and mobile platforms, which have dramatically reduced physical constraints, propelling this age-old practice into a modern, scalable model.

Resource-centric competition is based on a service-driven resource that meets a particular customer’s need and then tries to utilize as much of that resource as possible. Success is measured by the average percentage of the maximum capacity used over time. In competitive terms, this would represent a share of utilization.

The Democratizing Force of Platform-Centricity: A Distributive Pathway to Growth

Platform Centricity operates on the principle of ‘Distributive’ dynamics—it serves as a nexus that aggregates supply and demand in a robust marketplace or a digital ‘market space.’ Prominent examples include Amazon’s Marketplace, eBay, and Facebook, which all serve as bustling arenas where participants can interact, trade, and extract value.

Far from being a modern invention, this concept of marketplace interaction dates back to historical trade routes like the ancient Silk Road. The digital revolution sets today’s platform-centric models apart: the walls of geography and time are torn down, replaced by the immediacy and ubiquity of digital platforms that facilitate exchanges at an unprecedented scale and speed.

Platform-centric competition is all about the hub where participants fulfill each other’s needs and grow participation. Success is measured by the number of participants in the network and the number of transactions between them. In competitive terms, this would represent a share of transaction.

In a rapidly changing landscape where customer retention and optimal resource utilization are paramount, as-a-service models have surged to prominence. These models find their place on the retention side of the RoundMap framework and are embodied by two distinct paradigms: Resource-centricity and Platform-centricity.

Resource-centricity is the epitome of regenerative strategy, focusing on maximizing asset utilization, whether airline seats or shared cars. It operates in a realm where every ounce of resource is meticulously allocated to deliver maximum value. Platform-centricity, on the other hand, thrives on distributive dynamics, connecting an array of suppliers and consumers in a marketplace environment fueled and scaled by digital technology.

These as-a-service models complement their as-a-product counterparts by offering different routes to value creation and customer engagement. Together, they comprise the four quadrants of the Business Model Matrix; each is distinguished by its core business logic and value positions—creating a rich tapestry of 16 unique business model variations.

The figure below gives you a clockwise overview of the Four Archetypal Business Models of the Business Model Matrix, their leverage, and some of their traits:

Business Model Evolution

Technology is a key driver of evolution across all these business models, not just in terms of operational efficiency but also in enriching the customer experience and using resources effectively. While each model has a constant core philosophy, their peripheral activities and strategies continually adapt to the zeitgeist.

Let’s look at each Archetypal Business Model from a historical and a future perspective:

Product-Centricity: “Exploitative”

Historical Evolution:

Traditionally, product-centric businesses have been built on manufacturing efficiencies, mass distribution, and heavy investment in advertising. This model has its roots in the Industrial Age, where economies of scale were critical.

Future Evolution:

Technological advancements in manufacturing and AI are pushing these models toward greater personalization. Although the core remains product-centric, there’s an increased focus on customer data analytics to predict consumer behavior and adapt products accordingly.

Customer-Centricity: “Explorative”

Historical Evolution:

Initially, customer-centricity was almost exclusively related to service industries like hospitality and healthcare. The concept has broadened to encompass all sectors, especially with the rise of CRM software that enables businesses to maintain customer focus.

Future Evolution:

With advancements in AI and machine learning, customer-centric models will likely become increasingly predictive, offering solutions to customers before they even realize they need them. Ethics around data usage will become a critical focus.

Resource-Centricity: “Regenerative”

Historical Evolution:

This model finds its roots in ancient practices of resource sharing but has evolved significantly with technology. Car-sharing, co-working spaces, and software as a service (SaaS) are modern iterations.

Future Evolution:

Expect more decentralized and democratized platforms where users can contribute to the resource pool, such as decentralized energy grids. IoT will enable smarter, more efficient utilization of resources.

Platform-Centricity: “Distributive”

Historical Evolution:

Historically, this could be traced back to ancient marketplaces and bazaars. The model has been supercharged in the digital age, with platforms like eBay, Amazon, and social media serving as expansive, global marketplaces.

Future Evolution:

Blockchain and smart contract technologies could make these networks more transparent and equitable. There will likely be a rise in decentralized networks, reducing the power of the central platform and distributing it more evenly among participants.

Business Model Regeneration

Additionally, we’ve created an overview of how these business models evolved over time as a result of advancing technological innovation. We called it Business Model Regeneration.

Bridging Business Models and Value Disciplines

You may already be familiar with Treacy & Wiersema’s classic framework outlining three types of value positions a company can adopt. Intriguingly, I discovered that these value disciplines can be mapped onto the same 2×2 matrix of the Business Model Matrix. However, it became evident that a fourth discipline was needed to complete the picture.

According to Treacy & Wiersema, a company’s value position is determined by external perception regarding what the organization excels at. To establish a potent value position, one must adhere to four guiding principles:

- Excel in at least one value discipline, setting you apart from competitors.

- Maintain industry-standard levels in the other disciplines to remain competitive.

- Strive for continuous improvement to dominate your market sector.

- Align your operational and organizational model to support the chosen value discipline strongly.

The three traditional value disciplines are:

- Product Leadership: This aims to propel product development and innovation. Organizations strive for better quality, faster delivery, sleeker design, and cost-efficiency.

- Customer Intimacy: This focuses on comprehensively understanding the customer’s needs to provide personalized solutions. The aim is to deepen customer relationships through customization and superior service.

- Operational Excellence: The goal is to deliver high-quality products or services at competitive prices and maximum convenience. The emphasis is on operational efficiency, automation, and impeccable service delivery.

When observed in sequence, these three value disciplines intriguingly follow the same pattern as the Four Archetypal Business Models, providing a remarkable symmetry.

The Fourth Value Discipline: Network Orchestration

However, this trio of value disciplines was missing a crucial element, especially considering the rapid advancements since Treacy & Wiersema first introduced their concepts in 1993.

The rise of e-commerce brought forth new possibilities, including real-time inventory tracking and robust online payment systems, paving the way for large trading platforms such as Amazon’s Marketplace and eBay. Given these developments, we found it necessary to introduce a fourth discipline: Network Orchestration.

While some argue that Network Orchestration could be considered a business model, we propose that it serves better as a value discipline. Our perspective aligns with a Harvard Business Review article, which, after examining 40 years of financial data, indicated that “Network Orchestrators outperform companies with other business models on several key dimensions.”

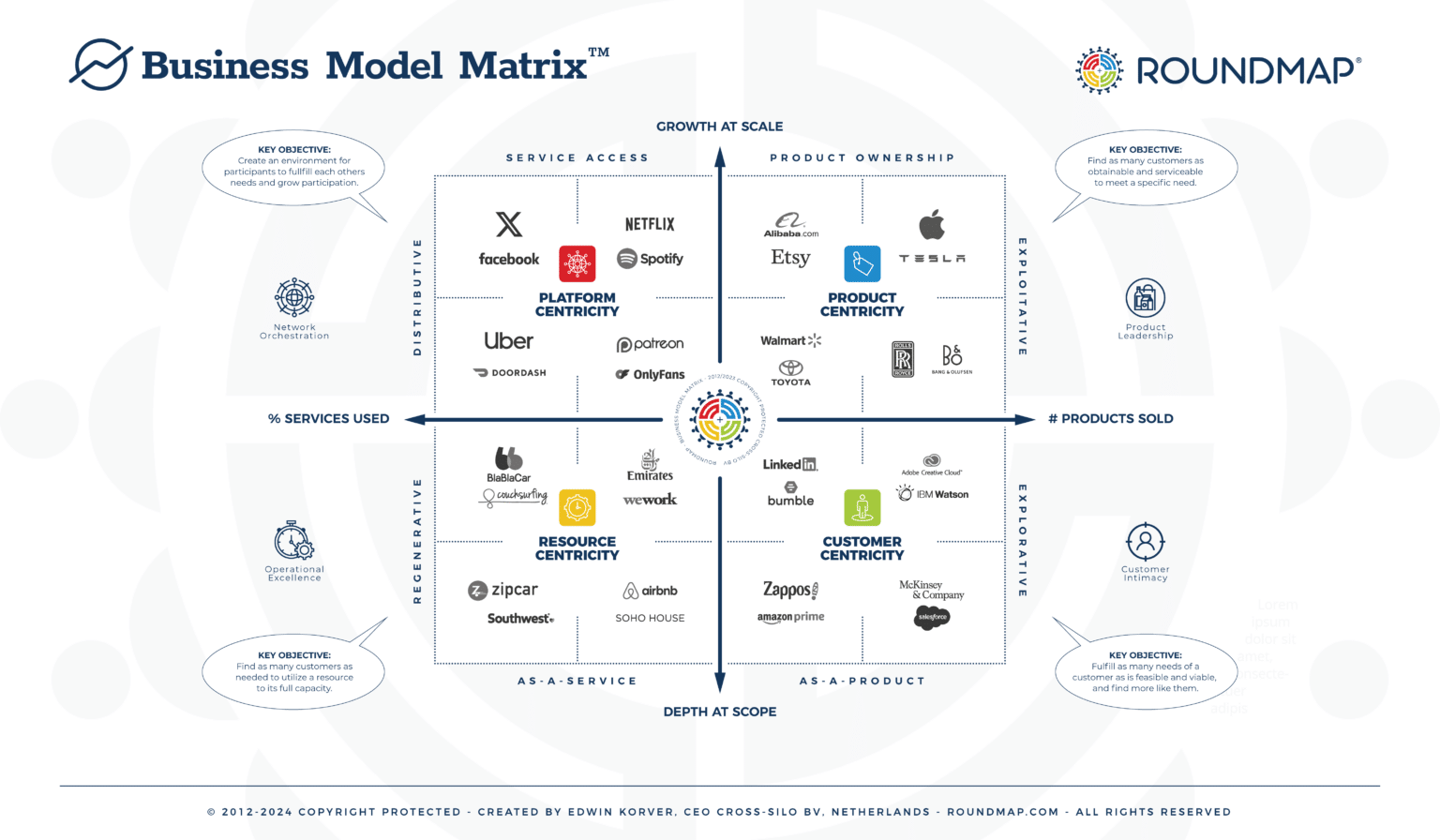

A Deep Dive into the 16 Business Model Variations

In a rapidly evolving business landscape, adaptability is critical. Yet, adaptability needs a compass—a framework to guide transformative change. That’s where the Business Model Matrix™ comes into play.

Within this matrix lie 16 unique business model variations, each a blend of one of the Four Archetypal Business Models and one of four value disciplines. These variations are theoretical constructs and practical routes for businesses to adapt, excel, and create equitable value for all stakeholders.

The following analysis thoroughly explores each unique model, offering real-world examples, potential opportunities, and inherent risks. This matrix is not a mere intellectual exercise; it’s a living guide, helping organizations create a symphony of strengths:

1. Product-Centric & Product Leadership

Characteristics: Prioritizes a culture of consistent innovation and change. Strives to create distinct and groundbreaking products.

Examples: Apple and Tesla.

Opportunities: Innovations can create entirely new markets.

Risks: High R&D costs; constant need to innovate.

2. Product-Centric & Customer Intimacy

Characteristics: Focuses on creating specialized products for individual customers or market segments. Intense interaction with customers to deeply understand their unique needs.

Examples: Rolls Royce and Bang & Olufsen.

Opportunities: Customization can yield high margins.

Risks: Operations can become complex and costly.

3. Product-Centric & Operational Excellence

Characteristics: Streamlined operations to reduce costs and improve productivity. Delivers uniform products/services at large scales.

Examples: Walmart and Toyota.

Opportunities: Efficiency and scale can undercut competitors.

Risks: Margins are thin; operational failures can be catastrophic.

4. Product-Centric & Network Orchestration

Characteristics: Builds a community around its product offerings. Rapidly grows by leveraging networks and ecosystems.

Examples: Alibaba and Etsy.

Opportunities: Leverages network effects to grow.

Risks: Dependent on maintaining a balanced ecosystem.

5. Customer-Centric & Product Leadership

Characteristics: Emphasizes adding value through both the product and deep customer relationships. Uses insights from customer relationships to inspire product innovation.

Examples: IBM’s Watson and Adobe Creative Cloud.

Opportunities: Deep customer relationships facilitate successful product launches.

Risks: Over-reliance on a limited customer base.

6. Customer-Centric & Customer Intimacy

Characteristics: Forms deep, long-lasting relationships with customers. Offers customized solutions based on individual customer needs.

Examples: Salesforce and McKinsey & Company.

Opportunities: High customer loyalty; less sensitive to price competition.

Risks: High dependence on relationship management.

7. Customer-Centric & Operational Excellence

Characteristics: Seamlessly combines efficient operations with a customer-centric approach. Quickly adapts to customer feedback and preferences.

Examples: Amazon Prime and Zappos.

Opportunities: Scales well while maintaining customer satisfaction.

Risks: Operational complexity; high customer expectations.

8. Customer-Centric & Network Orchestration

Characteristics: Utilizes platforms to foster deeper customer engagement. Uses rich customer data for better decision-making and optimization.

Examples: LinkedIn and Bumble.

Opportunities: Generates rich customer data for ongoing optimization.

Risks: Requires vigilant platform governance.

9. Resource-Centric & Product Leadership

Characteristics: Focuses on maximizing the potential and value of its assets. Strives to improve user experience through its resources.

Examples: Emirates Airlines and WeWork.

Opportunities: Maximizes asset utilization; enhances user experience.

Risks: Capital intensive; vulnerable to market fluctuations.

10. Resource-Centric & Customer Intimacy

Characteristics: Leverages assets to foster a sense of community among users. Tailors its resources based on specific customer preferences.

Examples: Airbnb and Soho House.

Opportunities: Community-building enhances asset utilization.

Risks: Quality control is challenging.

11. Resource-Centric & Operational Excellence

Characteristics: Focuses on the most efficient use of its resources. Can scale its resources to meet demand.

Examples: Southwest Airlines and Zipcar.

Opportunities: Efficiency maximizes asset utilization.

Risks: Margins may be thin, dependent on high utilization rates.

12. Resource-Centric & Network Orchestration

Characteristics: Encourages a sharing economy model using its resources. Prioritizes building trust within the community for shared resources.

Examples: BlaBlaCar and Couchsurfing.

Opportunities: Low operational costs; network effects.

Risks: Requires strong community governance.

13. Platform-Centric & Product Leadership

Characteristics: Relies heavily on high-quality content to attract and retain users. Often uses subscription models to generate consistent revenue.

Examples: Netflix and Spotify.

Opportunities: Scales easily; low marginal costs for adding new users.

Risks: Expensive content acquisition; piracy.

14. Platform-Centric & Customer Intimacy

Characteristics: Puts creators or content generators at the center of its strategy. Utilizes platforms to foster deep engagement between creators and consumers.

Examples: Patreon and OnlyFans.

Opportunities: Strong creator-customer relationships.

Risks: Reliance on platform and community governance.

15. Platform-Centric & Operational Excellence

Characteristics: Emphasizes lean operations to improve profitability. Can rapidly adjust to changes in demand.

Examples: Uber and DoorDash.

Opportunities: Lean operations; scales rapidly.

Risks: Regulatory challenges; labor issues.

16. Platform-Centric & Network Orchestration

Characteristics: Prioritizes creating interconnections between users to foster a sense of community. Uses vast user data for various purposes, from advertising to product improvements.

Examples: Facebook and Twitter.

Opportunities: Near-zero marginal costs; rich data capture.

Risks: Governance challenges; privacy concerns.

The Convergence of Business Models and Value Disciplines: A Foundation for Strategic Innovation

In sum, we’ve embarked on an intellectual journey to untangle the complexities of business strategy. Through the lens of the Business Model Matrix™, we’ve identified and positioned Four Archetypal Business Models alongside four value disciplines. This comprehensive framework offers an unparalleled tool for planning and executing robust and adaptable strategies. But let this not be the end; instead, consider it an open invitation to engage in ongoing discourse. There are layers yet to be peeled, insights yet gleaned, and evolutions yet to unfold.

We invite you to stay connected—whether through our upcoming articles or newsletter—as we continue exploring, refining, and challenging these foundational ideas.

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM