A Comprehensive Framework for Planning Meaningful Impact, Breaking Down Silos, Elevating Organizational Performance, and Fostering Equitable Business Practices

In a world undergoing rapid transformation, where the tectonic plates of technology, society, and economics shift beneath our feet, one truth emerges: businesses that stay rooted in old paradigms will crumble.

We are caught in the currents of the Longwave business cycle, a transformative era that challenges every rule we thought we knew. Edwin Korver: ‘We stand not just at a threshold but at a gateway to a future where the lines dividing business sectors, stakeholders, and societal roles blur into a holistic tapestry.’

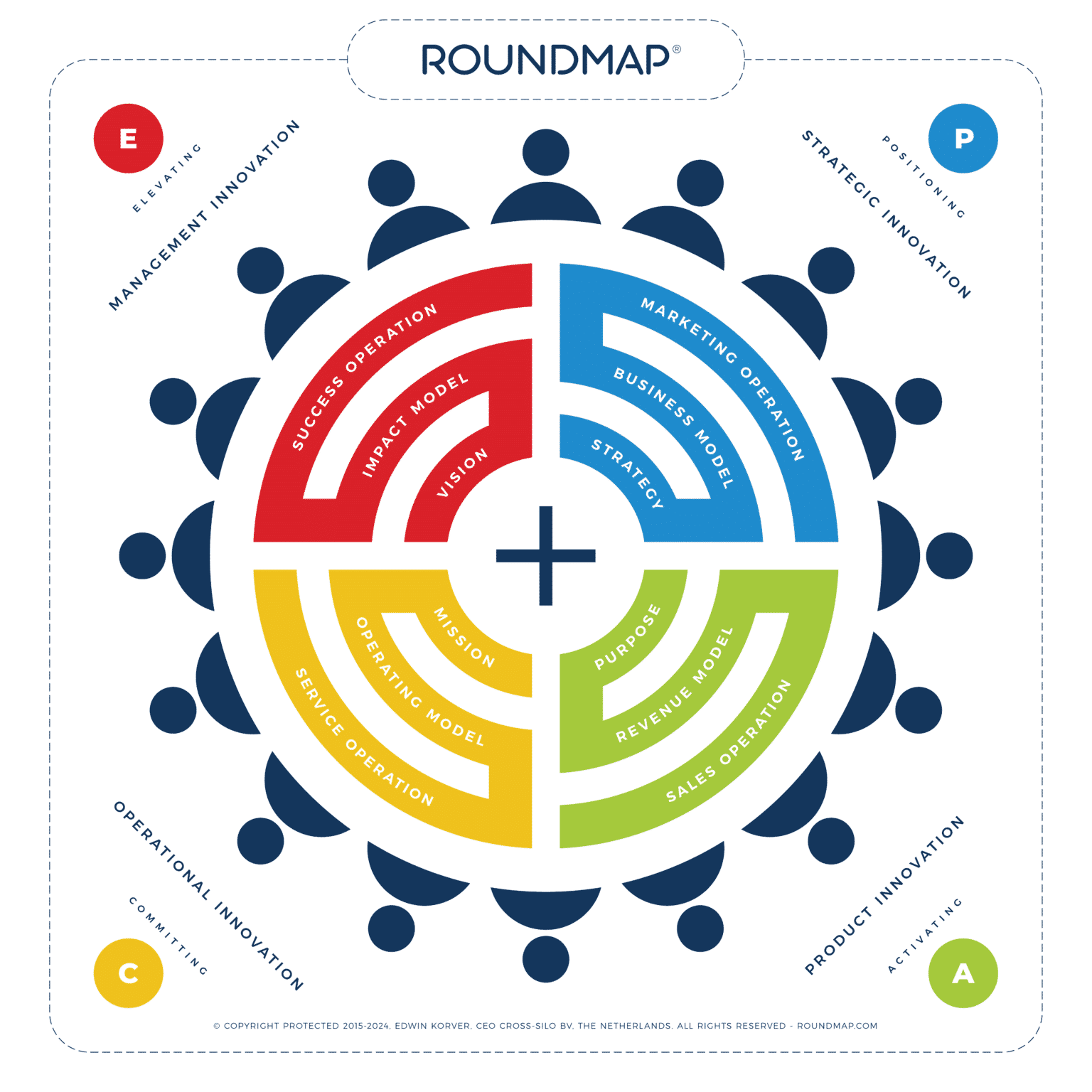

Enter RoundMap®, a guide for this new world, conceived out of a simple yet powerful question: ‘What if the division of labor, which has siloed us into isolated units, could be transcended — and planning for impact could build bridges helping businesses to achieve sustainable growth?’

We invite you to join us on an extraordinary journey. Picture yourself as a ValueActor, a crucial player in a complex network of relationships or ValueCircles. In a cycle of perpetual motion, you and your organization contribute to a vibrant ecosystem through planned impact. A Symphony of Strengths harmonizes as all members bring their unique contributions to the table, bound together by shared values and purpose. Edwin Korver: ‘This is not about a single virtuoso performance but a collective masterpiece, each note as vital as the next.’

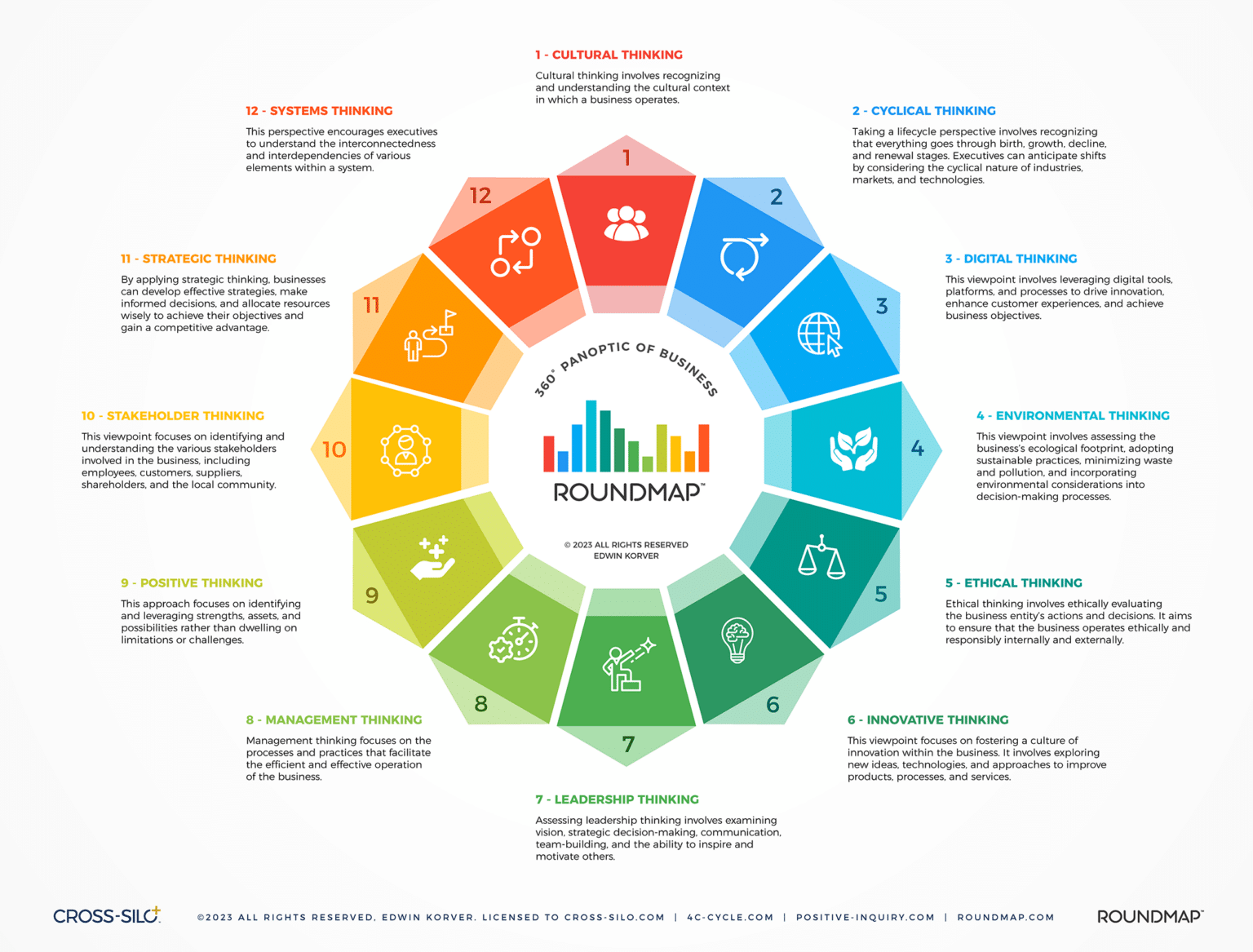

As we navigate together through uncharted territories, you’ll discover new principles that redefine what it means to be a business in the 21st century. For one, we’ll consider the Leadership Compass, consult the Panoptic of Business, explore the Business Navigator, and embrace the Impact Model—each a landmark in our quest to usher in an era of equitable, impact-driven organizations.

RoundMap® is more than just a framework; it’s the embodiment of a new organizational philosophy oriented towards planned impact. Edwin Korver: ‘We’re fostering not only businesses but equitable ecosystems where people find purpose and belonging, all while contributing meaningfully to society at large.’

Join us in this transformational adventure as we collectively redefine what it means to be a thriving, equitable, and impactful business in today’s interconnected world.

RoundMap® is Applied Wisdom Across Worlds©

Quick Introduction to RoundMap®

The RoundMap® Unified Approach to Systemic Change is a robust and transformative framework that meticulously addresses the multi-dimensional aspects of business strategy, organizational development, and sustainable growth. It enlightens the complexities of these components and bridges the gaps that hinder organizations from realizing their full potential.

The Impact Model strengthens the framework as an essential piece emphasizing the importance of designing for impact and measuring progress towards sustainability objectives. This model motivates businesses to move beyond buzzwords, take deliberate actions, and create a lasting positive difference, setting them apart from competitors.

RoundMap® amplifies often overlooked phases of the customer lifecycle, such as customer success, and introduces the concept of significance to underscore the necessity of understanding and meeting future customer needs to nurture enduring relationships.

The Business Model Matrix and the Business Navigator offer a comprehensive bird’s eye view of existing and emerging business models, facilitating non-linear growth. RoundMap® also promotes Consentricity, a revolutionary approach to distributed leadership that moves away from traditional hierarchical structures, fostering robust, equitable and adaptable organizations.

Recognizing that change is inherent and vital in the modern business landscape, RoundMap® champions Positive Inquiry. This proactive stance encourages businesses to explore untapped markets and create innovative value propositions, aligning them with the concept of ‘blue oceans’. The focus is shifted from competition-driven differentiation to the creation of innovative markets.

Storycasting becomes a pivotal tool within RoundMap®, transforming products and concepts into captivating narratives. These stories guide their placement along the Customer Dynamics Lifecycle, boosting organizational buy-in for change, and sparking new market opportunities.

Enhanced by the Thinking Caps methodology and the Panoptic perspective, RoundMap® is the epitome of a holistic business strategy. Meticulously crafted, it navigates the intricate business landscape, guiding organizations towards sustainable growth through adaptive strategies, shared leadership, effective planning for impact, and compelling storytelling.

- All-Round and Widely Applicable: RoundMap® encapsulates a 360-degree perspective, incorporating every facet of organizations into its comprehensive structure. Strategic decisions are derived from a complete understanding of the customer lifecycle, spanning from initial engagement to enduring satisfaction. Its one-size-fits-all approach remains uncompromising, catering to myriad businesses irrespective of their scale or industry.

- Impact-Conscious: RoundMap® places a significant emphasis on generating tangible impact. It encourages organizations to strategize, execute, and measure their business activities based on the real changes they hope to instigate. This impact orientation aids in creating meaningful differences in industries and society, aligning with modern consumers’ expectations.

- Value-First: Being deeply value-driven, RoundMap® stresses creating and delivering value as the main driving force. It evaluates business models and maps the entire value chain, aligning every organizational aspect towards catering to customer needs and objectives. The value-first approach further bolsters customer loyalty while attracting prospective clients.

- Human-Centric: By recognizing business success’s heart lies in establishing meaningful relationships, RoundMap® is deeply human-centric. It appreciates the roles of all stakeholders, from customers and employees to partners and investors, understanding that each contributes uniquely to the business’s growth and success.

- Story-Driven: RoundMap® understands that impactful narratives resonate more effectively than product-centric pitches, and hence champions storycasting. By connecting with audiences on an emotional level, it cultivates long-lasting relationships that extend far beyond business transactions.

- Consentric: RoundMap® employs Consentricity to underscore its ability to align all business elements in harmonious synchronization. Each concentric layer — from leadership roles to operational functions — reinforces others, fostering a cohesive and efficient organizational ecosystem.

- Distributive Leadership: RoundMap® adopts a forward-thinking stance towards leadership, endorsing a distributive model that juxtaposes traditional hierarchical structures. This paves the way for the distribution of decision-making responsibilities, fostering empowered and agile teams.

- Augmentative: RoundMap® harnesses advanced technology, such as AI and data analytics, to enhance the decision-making process and governance. This tech-friendly approach allows organizations to adapt to dynamic markets continually, standing resilient amidst profound market changes, while never swaying from its foundational principles.

The RoundMap® framework, a comprehensive and unified approach encompassing every facet of business, from strategic planning to client interaction, is an invaluable tool for organizations. RoundMap® guides strategic decision-making by integrating customer insights, market analysis, and goal establishment. This fosters a holistic understanding of business operations, cultivating cross-functional collaboration, distributive leadership, and consent-based decision-making.

RoundMap’s Storycasting method ensures consistent and impactful messaging to stakeholders, while its delineation of leadership roles and responsibilities fuels leadership development and alignment with organizational goals.

Operational functions like marketing, sales, and customer service are streamlined within the framework, enhancing operational efficiency.

RoundMap® encompasses change management and innovation strategies, assisting organizations in navigating transitions and uncovering growth opportunities. By furnishing measurement metrics and key performance indicators aligned with business goals, RoundMap® empowers organizations to monitor progress and enact data-driven decisions. Its adaptive structure maintains relevance in dynamic markets, while its role in fostering organizational alignment cultivates collaboration and a shared sense of purpose across all organizational tiers.

Ultimately, RoundMap® functions as a comprehensive roadmap, expertly guiding organizations through strategic, operational, and communicative pursuits with unwavering clarity and effectiveness.

Imagine navigating the intricate tapestry of modern business without a compass, a map, or even a guiding star. That’s how most organizations operate today: in fragmented silos, stumbling in the dark, detached from the holistic ecosystem they’re part of. We’ve crafted a suite of instruments to illuminate your path and orchestrate your journey toward an equitable, thriving future.

The Business Navigator is your strategic playbook, harmonizing all aspects of your organization into a cohesive, value-driven narrative. Think of it as your master score, where each department’s contributions are carefully arranged to create a Symphony of Strengths that resounds throughout the marketplace and society.

Our Customer Dynamics Lifecycle is the lifeblood pulsating through this symphony. It doesn’t just map out customer interactions; it delves into the emotional and transactional ebbs and flows, highlighting opportunities for meaningful connections. Every touchpoint becomes a note in a larger melody, elevating your brand and value proposition.

When challenges arise or transformations are needed, the Positive Inquiry Cycle serves as your philosophical cornerstone. This isn’t problem-solving; it’s possibility-enhancing. Inspired by the pioneering work in appreciative inquiry, this cycle invites your entire team to participate in creating affirmative visions of the future, grounded in your collective strengths and aspirations.

The Business Model Matrix acts as your navigational grid. Instead of boxing you into a single business model, it presents an expansive landscape of possibilities. This matrix encourages you to explore diverse revenue streams, stakeholder engagements, and value creation pathways, ensuring that your strategy is resilient, flexible, and aligned with your higher mission.

Finally, the Impact Model emphasizes the significance of planning for real, meaningful transformation and progress toward sustainability objectives. This model encourages organizations to strategize their business activities around the tangible impact they aim to instigate. It is also a key aspect of the Consentric Distributed Leadership Model, a leadership approach that aligns all elements of a business in harmonious synchronization.

These instruments are not isolated tools but interconnected elements of the RoundMap™ framework. They come together to form a comprehensive guide for any organization aiming to navigate the complexities of the 21st-century business landscape. A new paradigm awaits—let these instruments be your guide.

Embarking on the RoundMap® journey is akin to setting sail into uncharted waters. It promises discoveries that can redefine your organization, but such a voyage requires more than just intent; it demands precise navigation. Here’s where the rubber meets the road: the implementation of RoundMap® is not a mere ‘project’ but a paradigm shift, a re-orchestration of your entire organization.

Phase One: Readiness Assessment

Before we hoist the sails, we assess the wind and currents—a thorough organizational readiness check. Leveraging a combination of stakeholder interviews, analytics, and readiness metrics, we ascertain how prepared your organization is to break down silos and embrace new ways of thinking.

Phase Two: Harmonizing Instruments

Now, we introduce you to the core elements of RoundMap®—the Business Navigator, Customer Dynamics Lifecycle, Positive Inquiry Cycle, and Business Model Matrix. Teams are trained, and pilot projects are launched to facilitate a smooth integration of these instruments into your organizational DNA.

Phase Three: The Ensemble

The Symphony of Strengths cannot exist without a harmonious ensemble. Here, we align your departments and teams to act in concert, focused on value creation, equity, and a higher purpose. We deploy tools like Value Circles to connect disparate functions and foster an all-around, human-centric approach.

Phase Four: Mastering the Score

With your ensemble in place and your instruments attuned, you’ll be ready to tackle complex compositions—enterprises, markets, and social ecosystems. We revisit your Business Navigator, refining it to mirror the evolving dynamics within your organization and the world.

Phase Five: A Living Symphony

RoundMap® isn’t a one-off performance but a living, evolving symphony. Regular check-ins, adjustments and even course corrections keep the music flowing, ensuring your organization remains resilient, innovative, and equitable in an ever-changing landscape.

As you navigate through these phases, you’re not alone. Our coaches and consultants act as your seasoned navigators, lending expertise, offering critical feedback, and celebrating your milestones.

In implementing RoundMap®, you’re not just adopting a new strategy; you’re heralding a new era of business—an era of equitability, interconnectedness, and boundless potential. The voyage may be complex, but the rewards are immeasurable.

The Framework

The All-Seeing Eye: Navigating the Panoptic of Business

One of the instruments we created is the RoundMap® Panoptic. By putting on multiple Thinking Caps, you can obtain a panoptic view of your team, division, or business situation (panoptic is derived from the Greek panoptēs, meaning “all-seeing”).

Connecting Human Systems: Unlocking Collective Potential and Driving Sustainable Success

We are CROSS-SILO—our purpose is to connect human systems. We’re incredibly thankful to have had the opportunity to apply our Whole System Change approach at Fortune 500 companies, such as Omnicom Group and Canon USA ─ commissioned by KERN Agency and in collaboration with Prof. David Cooperrider and Prof. Ron Fry of Case Western Reserve University, the cradle of positive change.

Peter Drucker: “The organization’s unique purpose is to make strength productive. It cannot, of course, overcome the weaknesses with which each of us is abundantly endowed. But it can make them irrelevant.”

Edward de Bono: “Companies that solely focus on competition will ultimately die. Those that focus on value creation will thrive.”

Recent Articles

Impending Impact: Business Strategies Destined for Demise

The Inevitability of Impact Imagine a steadfast march along a path worn by decades of

Harnessing Informal Networks: The Key to Building Adaptability and Resilience

In a world where unpredictability is a certainty, businesses face the ongoing challenge of adapting

Navigating Uncertainty: From the 2D to the 3D Strategic Agility Matrix

The 2D Strategic Agility Matrix provides insights by plotting competitive advantage against market innovation—a reliable

Navigating Complexity: The Cynefin Framework and the Art of Adaptive Leadership

Leaders continually seek frameworks and methodologies to guide decision-making and strategy in the complex and

From Division to Unity: The Evolution of Community Design

The pressing need for a shift towards interconnectedness and collective thriving cannot be overstated in

Navigating the Future with the RoundMap’s Strategic Agility Matrix

In an era where the only constant is change, the ability to adapt and innovate

Rise to the Occasion: Navigating Complexity with Strategic Agility and Foresight

As constraints and boundaries shift, systems once considered ordered or complicated can transition into states

Beyond Optimization: Embracing Transformation in the Digital Age

Unfortunately, many organizations mistake digital optimization for digital transformation. While optimizing existing processes more efficiently