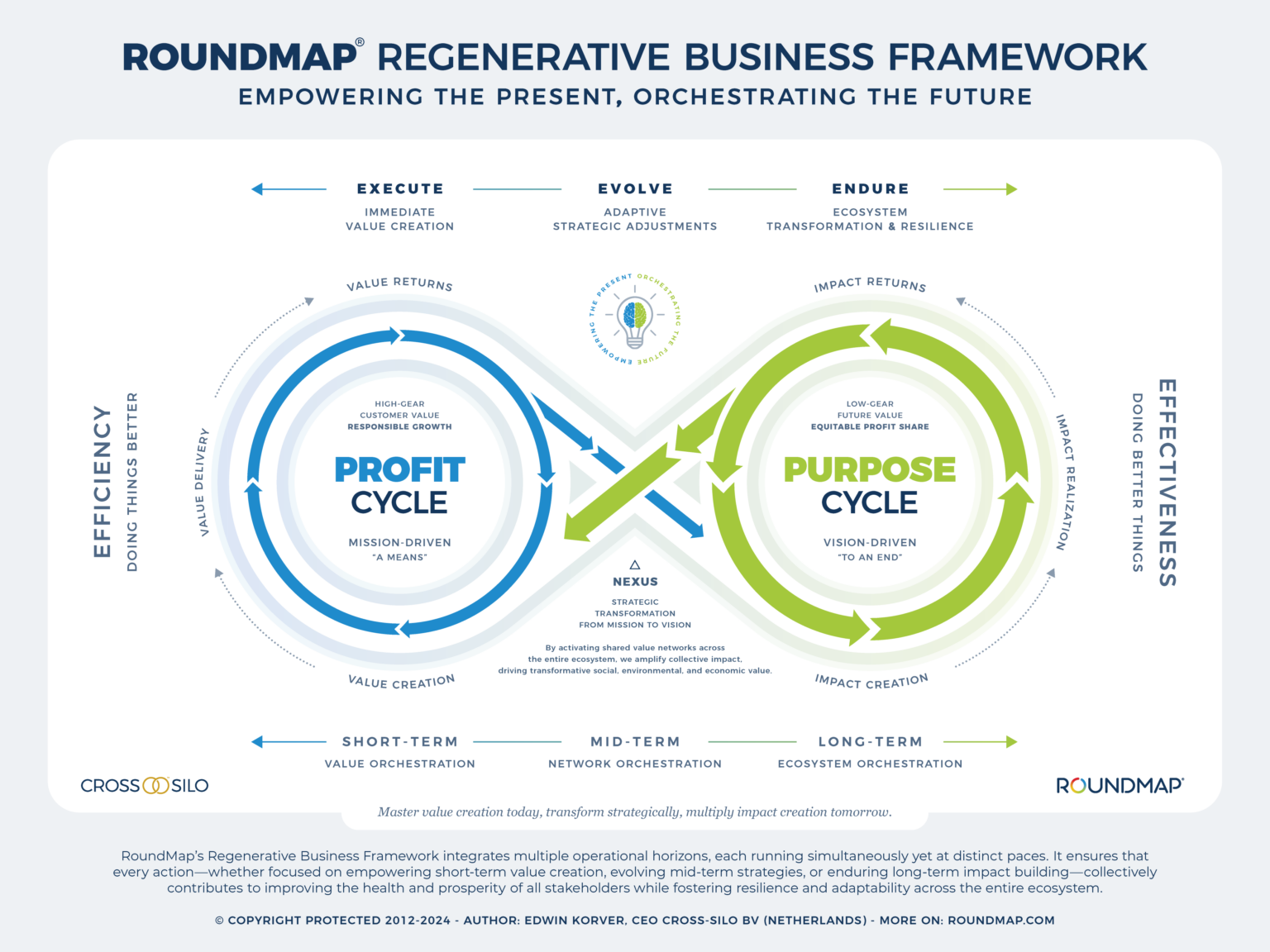

The RoundMap’s Regenerative Business Framework proposes a dual-cycle approach to business: one focused on value creation and another on impact. However, reality presents us with a practical challenge: most organizations aren’t structured or resourced to operate at two different speeds simultaneously. Financial pressures and commitments often force them to prioritize short-term profitability over long-term impact.

Think of it like a four-wheel drive vehicle: you must choose between low or high gear depending on the terrain—you can’t engage both simultaneously. Similarly, businesses need to optimize their operations for current conditions to remain profitable. And while long-term impact is crucial, no business can pursue it while ignoring short-term results.

This raises a critical question: How can businesses orchestrate meaningful impact while maintaining their focus on value creation? The answer might suprise you—through shared value networks (SVNs). These networks act as intermediate organs that allow businesses to maintain their operational focus while participating in broader impact initiatives. This is particularly significant given that most organizations already struggle with internal functional silos and stratification. Building effective shared value networks requires not only breaking down these internal barriers but also crossing organizational boundaries to create collaborative ecosystems that can drive systemic change.

This is where our expertise comes in. We specialize in building and nurturing shared value networks that amplify positive impact while mitigating adverse effects across all participants. Our guiding principle reflects this approach: “Master value creation within, while multiplying impact through shared value networks.”

The Shift to Shareholder Primacy

The shift to shareholder primacy has coincided with concerning trends:

- 40% decline in publicly listed companies

- Plunge in Fortune 500 life expectancy from 75 to 15 years

- Worst shareholder returns since the Great Depression

The Reinvestment Imperative

When companies fail to reinvest adequately in their stakeholder ecosystem:

- Employee talent and commitment erode

- Customer loyalty declines

- Innovation capacity withers

- Operational resilience weakens

- Competitive advantage disappears

Like fishing with dynamite, pure extraction might boost short-term catches, but it destroys the ecosystem that makes future fishing possible.

The Legal Reality

Importantly, there’s no legal requirement to maximize shareholder value. The business judgment rule explicitly protects decisions to reinvest in stakeholders and future capabilities. The notion that companies must prioritize short-term returns over long-term value creation is a myth – one that’s damaging companies and shareholders alike.

Book tip: The Myth of Maximizing Shareholder Value by Lynn Stout, a Distinguished Professor of Corporate and Business Law at Cornell Law School. Professor Stout is an internationally-recognized expert in corporate governance, financial regulation, and moral behavior [Amazon bookstore].

Building Regenerative Business

The dual-cycle framework offers a practical path forward. By explicitly acknowledging and managing both high-gear and low-gear operations, organizations can:

- Maintain current performance while building future capabilities

- Balance value capture with value creation

- Serve diverse stakeholder needs effectively

- Build resilient, adaptable organizations

- Create sustainable long-term value

This isn’t just theory – it’s supported by history, law, and mounting evidence that pure extraction strategies ultimately fail everyone, including shareholders.

The Only Way Forward

In today’s interconnected world, future value creation depends on:

- Healthy stakeholder ecosystems

- Strong innovation capabilities

- Organizational adaptability

- Environmental and social sustainability

These can only be achieved through systematic reinvestment of returns. The alternative is the extraction spiral we see destroying company after company.

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM