Let’s return to one of RoundMap’s foundations: the Business Model Matrix.

Within it, I originally identified four foundational business models: Customer Centricity, Product Centricity, Resource Centricity, and Platform Centricity. At the time, these felt fundamental—not just to how companies operate, but to how they make profit. They appeared to describe the essential logics of business itself.

Over time, however, as my work moved steadily toward regenerativity, I began questioning something deeper than business models. I began questioning the very foundation of capitalism—capital.

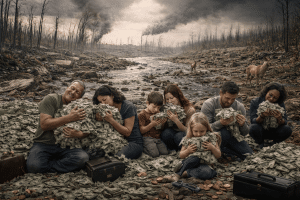

If capital sits at the root of modern business, then it is hardly surprising that most value attractors are designed to generate more of it. Growth pulls toward accumulation. Incentives bend toward extraction. Success becomes synonymous with capital expansion.

This, I believe, is where capitalism took a wrong turn.

Early thinkers—Adam Smith foremost among them—did not envision an amoral system driven purely by accumulation. Smith explicitly assumed the presence of a strong moral fabric, social norms, and civic responsibility. Markets were to be free, yes—but embedded within ethical restraint and social accountability. Competition was meant to serve prosperity, not dominate it.

That assumption, known as the invisible hand, proved dangerously optimistic.

The combined force of human greed and the desire for power, later legitimized by Friedman’s doctrine that profit maximization is the primary responsibility of business, inverted the system. Profit ceased to be an outcome and became the foundation. A thriving economy was replaced by a thriving balance sheet. The “invisible hand” no longer guided morality—it excused its absence.

So the question becomes unavoidable:

If capital should not be at the center of business—what should be?

My answer is: value.

Not capitalized value. Not monetized value. But value as such.

Value cannot be sold, owned, hoarded, or stockpiled. It can only be perceived—by stakeholders, communities, ecosystems, and future generations. It emerges through use, contribution, trust, meaning, and continuity. Capital is a representation of value; it is not value itself.

This introduces a new orientation: Value Centricity.

Value Centricity is not a business model, but a viability model of business. It does not restrain behavior or prescribe morality; it simply determines continuation. When value is allowed to circulate and regenerate, viability persists. When value is extracted beyond regeneration, the conditions for continuation dissolve. Value resists short-term optimization and reveals itself only over time, through multi-generational effects that no KPI can capture. And yet, it is precisely this long-term emergence of value that drives true prosperity, sustainability, and equitability.

Capital-centric systems ask: How do we extract more?

Value-centric systems ask: How do we contribute more—and allow value to circulate, compound, and regenerate?

Seen this way, regenerativity is not an ethical add-on to capitalism. It is a correction of its foundational error. Not by rejecting markets, but by re-centering them on what was always meant to matter—value as lived, shared, and sustained.

Capital follows value ─when value leads, capital behaves.

Final Thoughts

Value Centricity is not moral. And it doesn’t need to be.

Morality presumes intention, restraint, enforcement, or virtue. Value does none of that. Value is indifferent. It does not judge. It does not punish. It simply responds.

Value Centricity operates under a different logic altogether—closer to ecology, physics, and thermodynamics than ethics.

Value is not something a business claims: it is something a system confers.

A business may propose, offer, or attempt to create value—but whether value exists is decided externally, through perception, use, contribution, and continuity. Value either flows, or it doesn’t. It either regenerates, or it collapses.

There is no restraint mechanism required, because there is no loophole.

When a business aligns with value flows—it is carried forward.

When it begins to extract value faster than it can circulate or regenerate, the system does not morally object. It simply loses coherence. Trust erodes. Participation declines. Resources thin out. Optionality disappears.

What follows is not punishment: it is expulsion by irrelevance.

The company is not stopped because it is “wrong.” It stops because the conditions that made it viable no longer exist.

In that sense, Value Centricity is not a center of ethics, but a center of gravity.

- Capital-centric systems optimize capture.

- Moral systems attempt restraint.

- Value-centric systems obey consequence.

And consequence is inescapable.

Value cannot be hoarded because it decays without circulation. It cannot be extracted indefinitely because extraction collapses the source. And it cannot be faked long-term because perception adjusts.

This is why Value Centricity is so difficult to manipulate—and so powerful.

It doesn’t ask businesses to “be good.” It simply removes the conditions under which non-contribution can persist.

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM