Why Capitalism Struggles with the Laws of Nature

Economic theories such as Donut Economics, Earth Overshoot Day, and planetary boundary frameworks have made one thing abundantly clear: resources are finite, and human activity must operate within ecological limits. These models rightly emphasize thresholds, scarcity, and systemic risk. Yet despite their insight, they struggle to alter behavior at scale.

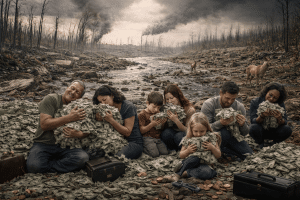

Capitalism, as it currently operates, is governed by a singular objective: the growth of financial capital. Indicators such as GDP, profit, and shareholder value reward throughput, speed, and accumulation, while remaining largely indifferent to the condition of the systems from which value is drawn. The laws of nature—regeneration rates, carrying capacity, interdependence—are treated as externalities rather than governing constraints.

What is missing is not awareness, but accountability.

To introduce accountability, we must first rethink what value is, where it comes from, and how it should be governed.

Value Does Not Originate in Organizations—It Flows Through Them

A foundational misunderstanding in mainstream economics is the assumption that value is created within firms. In reality, organizations are intermediaries in much larger value flows that originate in living systems.

Value exists in two fundamentally different but interdependent states:

Value Stores: Potential Value

Value Stores are reservoirs of capacity. They hold value at rest.

Examples include:

- Natural capital (oil, soil, water, biodiversity).

- Human capital (health, skills, knowledge).

- Social capital (trust, institutions, cohesion).

- Cultural capital (meaning, stories, norms).

- Infrastructural and financial capital.

These stores are not productive by themselves. They represent potential—the precondition for future value creation.

Value Flows: Mobilized Value

Value Flows are where value is put to use.

They emerge when:

- Resources are drawn from value stores.

- Combined with labor, knowledge, energy, and coordination.

- Transformed into goods, services, experiences, or capabilities.

- Circulated among value actors for utilization.

Flows are where economic activity becomes visible. But flows are always dependent on stores, and they always affect them.

Extraction Is Not the Problem—Unaccounted Depletion Is

Consider a familiar example: oil.

Oil is extracted from a natural value store, activated within value flows, and transformed into gasoline or plastics. These outputs circulate through the system:

- Gasoline enables mobility, work, and social participation.

- Plastic packaging extends shelf life, reduces food waste, and supports logistics.

These uses generate real value. They contribute to economic and social functioning. From a systemic perspective, this must be acknowledged.

However, two other effects occur simultaneously:

- The oil store itself is depleted;

- Non-recyclable plastics may poison other value stores—soil, water, ecosystems, even human health.

Here lies the core insight:

Value is only truly regenerated when it reappears as restored or enhanced capacity in Value Stores.

Circulation alone is not regeneration. Utilization alone is not sustainability: a system can be highly productive in its flows while silently destroying the very stores that make those flows possible.

Regeneration Is a Systemic Outcome, Not a Local Claim

This leads to a critical distinction that many sustainability narratives blur:

- Value creation happens in flows,

- Value regeneration happens in stores.

A value cycle may justify drawing down one store if it restores or strengthens capacity elsewhere in the system. Driving to work may increase human, social, or economic capital. Food preservation may reduce waste and enhance nutritional security.

Depletion, therefore, is not automatically wrong.

What is unacceptable is net depletion—when the total capacity of value stores declines over time.

This is where siloed thinking becomes destructive.

When organizations optimize locally—within a function, an industry, or a balance sheet—they often fail to see cross-store effects:

- Economic gains that erode ecological capacity;

- Convenience that undermines long-term health;

- Profit that dissolves social trust.

A flow that appears beneficial in isolation can be systemically harmful.

The Missing Instrument: A Ledger for Value Flows and Stores

Capitalism has one highly developed governance mechanism: financial accounting. Every organization keeps a ledger of capital—what is borrowed, what is earned, what is owed.

No equivalent ledger exists for value flows.

Valueism proposes that we introduce one.

The Value Flow Account

This ledger would track, across shared value networks:

- Value Store Depletion

What capacity is drawn down (e.g. resources, health, ecosystems); - Value Flow Contribution

What utility, functionality, or benefit is created and circulated; - Value Store Restoration

What capacity is replenished, renewed, or enhanced; - Cross-Store Damage

Where value flows degrade other stores unintentionally.

The decisive measure is not output, but net regenerative position.

A system is viable only if each value cycle restores at least as much total store capacity as it depletes—across the whole system.

Anything else represents borrowed value with unpaid interest.

From Externalities to Systemic Value Debt

What economics currently labels “externalities” are, in reality, unaccounted liabilities.

Pollution, ecosystem loss, burnout, erosion of trust—these are not side effects. They are signals of Systemic Value Debt: value extracted from flows without corresponding regeneration.

Just as financial debt accumulates silently until it triggers crisis, systemic value debt compounds across generations. Earth Overshoot Day is one expression of this imbalance—but it lacks a governance mechanism.

Value flow accounting changes that:

- Depletion becomes visible;

- Regeneration becomes measurable;

- Accountability becomes enforceable.

Governance Beyond Growth

With such a ledger in place, governance itself changes character.

Success is no longer defined by:

- Volume of throughput;

- Speed of circulation;

- Short-term surplus.

But by:

- Integrity of value stores;

- Balance between depletion and restoration;

- Growth in regenerative capacity over time.

This does not eliminate markets, innovation, or enterprise. It reframes their purpose.

True prosperity is not the acceleration of value flows, but the preservation and enrichment of the stores that sustain them.

Conclusion: From Managing Economies to Governing Living Systems

What emerges from this framework is not a moral critique of capitalism, but an upgrade to its operating system.

By introducing accountability for borrowed value—across ecological, social, human, and economic dimensions—we move from extraction to stewardship, from growth to viability, from short-term optimization to long-term governance.

Valueism does not ask whether we create value.

It asks:

- From which stores is value borrowed?

- Through which flows is it activated?

- To which stores does it return?

- And in what condition does the system emerge?

Only when these questions are governed—rather than ignored—can economies function as living systems rather than liquidation machines.

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM