If we were to consider that we may have reached the end of yet another technological cycle, how can we leap from the lessons learned during the previous cycle?

First, let me explain what cycle I’m referring to.

Economic Longwaves

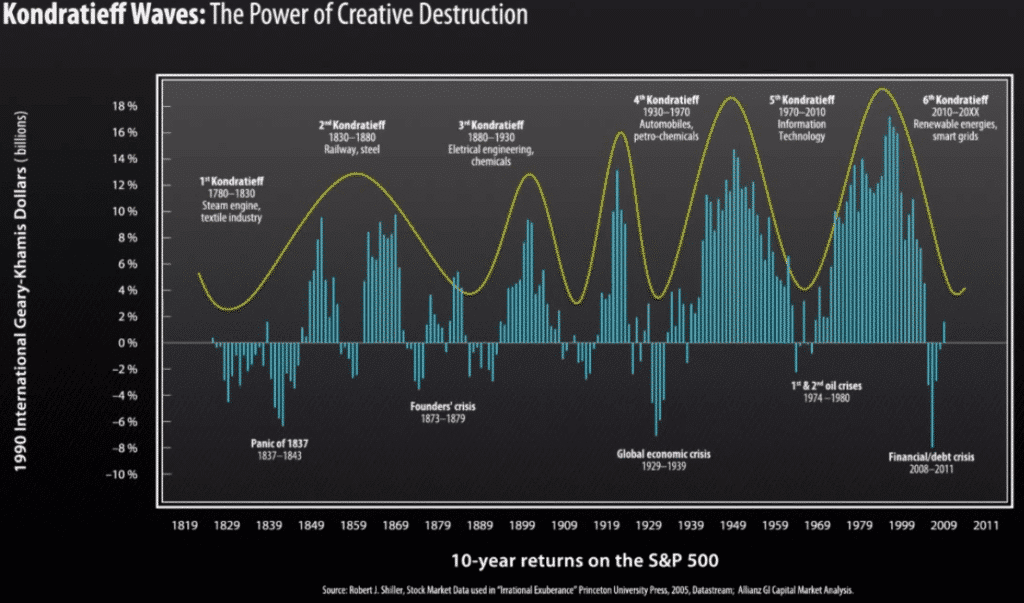

Recognized by renowned economists such as Joseph Schumpeter and Carlota Perez, Russian agricultural economist Nicolai Kondratieff suggested that capitalist economies go through long-term growth and decline driven by technological innovation.

These cycles, known as K-waves, are thought to last between 50 to 60 years. Considering the increased volatility, uncertainty, complexity, and ambiguity, we believe we may have reached the end of the 5th (1974-2024?) longwave.

Best-run companies

In their bestseller, In Search of Excellence, McKinsey consultants Peters and Waterman found that outperformers, coinciding with the end of the previous K-wave, lived the notion that people are their most important assets.

Contrary to the ruling notion of management in those days ─ that fanatical disrupters, the disturbers of the peace, needed to be contained in favor of continuity ─ these best-run companies believed that when people are in control of their destiny, led by intrinsic motivation and self-determination, they perform much, much better. Decades later, authors like Daniel Pink and Tim Collins would confirm these early findings.

Given that these giant companies were run from ivory towers, these initiatives needed to operate in stealth mode, often on a very tight budget, forcing them to rapidly test their assumptions by creating prototypes. They could scale up their initiatives when certain thresholds were met.

Many years later, Steve Blank and Eric Ries argued that this type of M.O. was unique to the LEAN start-ups in Silicon Valley, but they may have ‘overlooked’ the breakthrough study performed by McKinsey’s consultants on the incumbents.

Discrete Emergence

Working on the text …

Author

-

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."