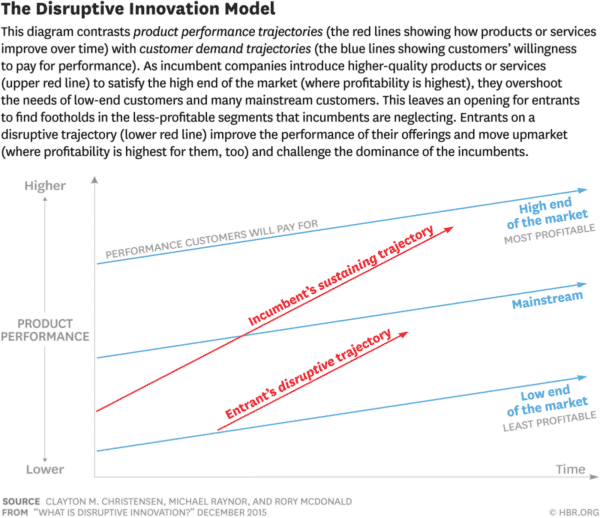

Clayton Christensen taught us that disruptive innovation challenges established markets and supply chains through the principle of creative destruction. Initially, small companies may introduce solutions that seem inferior and target neglected market segments at low prices. Over time, these solutions improve, attracting more customers and eventually disrupting the incumbents. This gradual improvement and market penetration highlight the transformative power of disruptive innovation.

Incumbents often respond to emerging challengers by enhancing their products with additional features and targeting upmarket customers willing to pay a premium. This strategy can backfire as it leaves fewer customers for incumbents, increasing pressure as more customers switch to the challenger’s evolving solution.

The Pressure Build-up to Outperform Rivals

This concept refers to the intense competition in business, likened to a pressure cooker, where companies face increasing managerial pressure to outperform rivals in speed, cost, and quality. This strategy, akin to cooking under high pressure for faster results, has its limits. Just as a pressure cooker cannot withstand unlimited heat, businesses cannot continuously escalate competition without risking severe consequences.

Ignoring Market Challengers is Unsustainable

It’s crucial to recognize that indefinitely delaying or ignoring market challengers is unsustainable. Continuously adding unwanted features or pushing for lower costs and higher productivity may provide temporary relief at a significant cost. It is essential to engage with customers to understand their needs, even if it means venturing beyond traditional comfort zones. This approach may require self-disruption, a strategy that, though risky, can lead to significant innovation and prevent obsolescence (consider the contrast between Kodak’s decline and Netflix’s rise).

Involve Employees in Shaping the Future

Avoid overwhelming your team with the stress of facing a losing battle. Instead, involve them in pioneering new directions for the company. Research by Coch and French (1948) shows that employees who shape the company’s future demonstrate greater commitment and investment. This collaborative approach alleviates pressure and fosters a more engaged and motivated workforce.

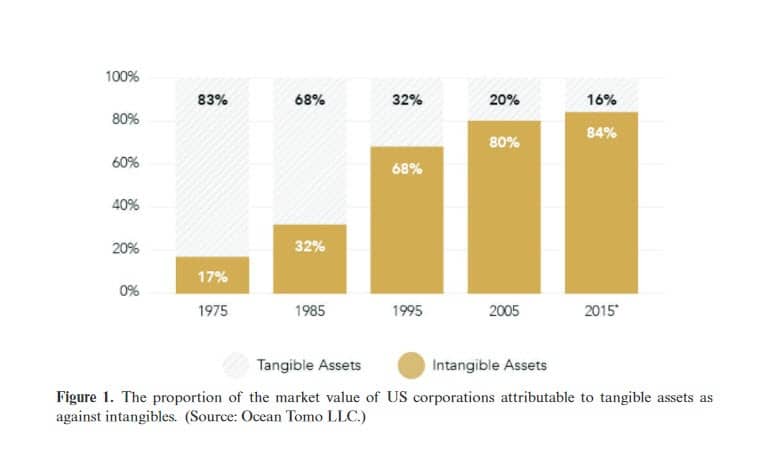

The Shift from Tangible to Intangible Assets

It’s essential to recognize that the nature of business assets has shifted dramatically from tangible (83% in 1975) to predominantly intangible (83% in 2015), emphasizing the increasing value of human capital and intellectual property. In today’s knowledge-driven economy, the true assets of a company are its people and the ideas they generate, making employee engagement and innovation key drivers of business success.

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM