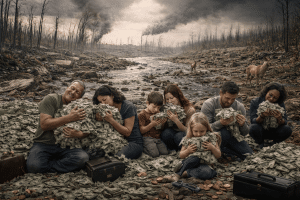

For decades, shareholder primacy has dictated corporate decision-making, driving businesses to prioritize short-term profits and disproportionate returns to shareholders over long-term sustainability and stakeholder value. This extractive model, where 50-80% of free cash flow is routinely funneled into dividends and stock buybacks, has led to widening inequalities, reduced innovation, and diminished investment in broader societal and environmental needs. But what if there’s a better way—one that generates even greater value for all stakeholders, shareholders included?

The Case Against Extractive Capitalism

The traditional model of shareholder capitalism captures an outsized proportion of profits, leaving limited resources for reinvestment in long-term growth and innovation. Consider:

Dividends and Buybacks: From 2015 to 2022, Fortune 500 companies spent $4.4 trillion on shareholder payouts, nearly double what they paid in federal taxes.

CEO Compensation: Average CEO pay has grown by over 1,200% since 1978, while worker wages have risen by just 15.3%.

Missed Opportunities: Companies with high shareholder extraction often underinvest in R&D, workforce development, and sustainability, limiting their capacity for innovation and resilience.

Value Distribution Imbalance: Estimates suggest that 50-80% of value returns are extracted by shareholders, leaving a mere fraction for reinvestment into systemic or long-term impact initiatives.

Dividends and Stock Buybacks:

- Global Trends: In 2022, the world’s top 1,200 companies distributed $1.39 trillion in dividends and spent a record $1.31 trillion on share buybacks, indicating a nearly equal split between these two methods of returning value to shareholders.

Source: Janus Henderson

- U.S. Corporations: Between 2000 and 2017, U.S. nonfinancial firms increased their share repurchases from 4.8% to 21.2% of operating income, while dividends remained relatively stable at around 14%. This shift highlights a growing preference for buybacks as a means of rewarding shareholders.

Source: National Bureau of Economic Research

- Shareholder Payouts vs. Taxes: From 2015 to 2022, 280 profitable Fortune 500 companies allocated $4.4 trillion to shareholders, with $2.7 trillion for stock buybacks and $1.7 trillion for dividends. Notably, these amounts were significantly higher than what these companies paid in federal income taxes during the same period.

Source: Americans for Tax Fairness

CEO Compensation:

- Growth Over Time: From 1978 to 2022, CEO compensation in the U.S. surged by 1,209.2%, far outpacing the 15.3% increase in typical worker compensation. This disparity has led to a substantial widening of the pay gap between executives and average employees.

Source: EPI

- Pay Ratios: In 2022, CEOs were compensated 344 times more than the typical worker, a significant increase from a 21-to-1 ratio in 1965.

Source: EPI

- Recent Figures: In 2023, the average total compensation for CEOs at S&P 500 companies rose to $17.7 million, marking a 6% increase from the previous year. This growth further widens the gap between executive pay and median worker wages.

Source: AFL-CIO

A New Paradigm: Growing the Pie

In his book “Grow the Pie,” Alex Edmans suggests that businesses can expand total value creation by pursuing both profit and purpose. However, this potential for growth faces a critical barrier: excessive value extraction by shareholders severely limits a company’s ability to create meaningful impact.

The solution lies in a more balanced approach to value distribution. When companies fairly share value among all stakeholders and intentionally reinvest in their business ecosystems, they create powerful networks of mutual benefit. This isn’t just about reducing negative externalities—it’s about harnessing collective momentum. By replacing value extraction with value circulation, businesses can accelerate their impact and achieve sustainable results far beyond what they could accomplish alone.

The key is recognizing that value shared is value multiplied. Each stakeholder becomes a catalyst for positive change, creating a compounding effect that benefits the entire system. This networked approach doesn’t just make impact possible—it makes it inevitable. We call this network effect the Shared Value Multiplier (SVM).

The Shared Value Multiplier can be activated by channeling value returns via shared value networks to optimize impact returns and grow the pie. By shifting from a mindset of competition over finite resources to one of collective growth, businesses harness the network effect to unlock exponential returns for all stakeholders. In doing so, they can achieve a balance that fosters innovation, strengthens resilience, and delivers enduring value for shareholders while simultaneously addressing societal and environmental challenges.

The Power of Shared Value Networks

Shared value networks transform how companies allocate free cash flow. By directing even a fraction of what is currently extracted by shareholders into initiatives that benefit all stakeholders, businesses can:

Amplify Impact: SVNs can multiply the effectiveness of investments by a factor of 2-4x through collaboration and resource sharing.

Example: Companies like Nestlé use shared value principles to align farmer livelihoods, community development, and supply chain efficiency, creating value for both stakeholders and shareholders.

Accelerate Time-to-Impact: The compounding effect of SVNs reduces the timeline for achieving measurable results by 50-75%, enabling quicker returns on investments in sustainability, innovation, and social impact.

Example: Renewable energy cooperatives demonstrate faster scalability and adoption rates when supported by collaborative networks.

Enhance Resilience: By investing in stakeholder ecosystems, businesses build goodwill, loyalty, and adaptability—key advantages in an increasingly volatile market.

The Business Case: Shareholders Benefit Too

By reducing and postponing shareholder extraction, thereby allowing the company to reinvest in creating shared value (CSV) does not mean sacrificing shareholder returns; it means optimizing them over time. Here’s how:

Higher Long-Term Returns: Companies with strong stakeholder relationships and sustainability initiatives consistently outperform their peers in financial metrics.

Risk Mitigation: Investing in societal and environmental resilience reduces exposure to regulatory, reputational, and market risks.

Expanded Markets: By addressing stakeholder needs, businesses create new demand and opportunities for growth.

Extractive versue Regenerative Investing

We’ve developed a formula that illustrates the importance of moving beyond early value extraction. It emphasizes the necessity of setting the record straight: ensuring that all stakeholders receive an equitable share of the value created within the Profit & Purpose Cycle.

The Vicious Cycle: Extractive Investing

First, let’s examine what is often referred to as ‘extractive capitalism,’ where shareholders disproportionately extract value from the Profit Cycle, leaving only minimal returns for other stakeholders.

Total Extractive Value = [(ValRet – ValExt) × (1/Cr)] × (ImpRet – ImpExt)

| ValRet | Value Returns | ImpRet | Impact Returns |

| ValExt | Value Extraction | ImpExt | Impact Extraction |

| ValCre | Value Creation | ImpCre | Impact Creation |

| Cr | Cycle Ratio | Ct1 | Profit Cycle Time |

| SVM | Shared Value Multiplier | Ct2 | Purpose Cycle Time |

When we set Value Returns at 100%, and shareholders extract 50-80% of the value, only 20-50% remains available for reinvestment to strengthen the firm’s ecosystem. If 75% of the value is withdrawn through mechanisms like share buybacks or dividends, it extends the timeline for generating impact returns by a factor of four.

If impact-making takes eight times longer to manifest than profit-making, a quarterly Profit Cycle would delay the Purpose Cycle’s ability to generate meaningful impact—stretching it to 8 years instead of 2.

For example: If Value Returns amount to 25M, and a staggering 75%—equivalent to 18.75M—is siphoned off for shareholder compensation, what’s left for everyone else? Just 6.25M—barely a fraction—is left for reinvestment. How can a company thrive, innovate, or sustain its ecosystem when scraps are all that remain for its future?

The Virtuous Cycle: Regenerative Investing

Now, consider an alternative scenario: generative investing.

Total Regenerative Value = [(ValRet – ValExt) × SVM × (1/Cr)] × (ImpRet – ImpExt)

By setting Value Returns again at 100% and channeling the full amount via Shared Value Networks, we can amplify impact and mitigate adverse effects through effective collaboration. This approach has the potential to create a multiplier effect (SVM) of 2-4 times or more. Not only would this bring impact realization closer, but it would also significantly amplify its magnitude. Once impact returns are generated, shareholders can be compensated generously, benefiting from a much larger pie.

For example: When Value Returns reach 25M and we leverage this to create a SVN-multiplier effect of 4, we have the potential to generate an impressive 100M in impact. By establishing an equitable share for shareholders—let’s say 20%—they can receive a substantial return of 20M. This approach leaves 80M (!) to benefit other stakeholders.

A Call to Action

It’s time for business leaders, investors, and policymakers to recognize that extractive capitalism is not just harmful but suboptimal. By reinvesting value returns into shared value networks, businesses can grow the pie for all stakeholders—including shareholders. This is not just a moral imperative; it’s a strategic advantage.

Let’s move beyond shareholder primacy to embrace a model where capital becomes a lever for systemic, sustainable value creation. The path forward is clear: grow the pie, share the benefits, and thrive together.

Continue Reading on Shared Value Networks:

Governing Value: From Extraction to Accountability in Living Systems

Why Capitalism Struggles with the Laws of Nature Economic theories such as Donut Economics, Earth Overshoot Day, and planetary boundary frameworks have made one thing

The Power of Three: Structuring Shared Value Regeneration

Beyond Value Creation In today’s dominant business paradigm, customer value creation is often held up as the gold standard of success. Yet beneath the surface,

Mapping the Future: We’re Writing the Book on RoundMap®

At RoundMap®, we believe the future of business lies in wholeness, not fragmentation. For too long, organizations have been shaped by linear thinking, short-term gains,

Walmart’s Shared Value Networks: How Walmart is working toward greater equity

This article was derived from a post on Walmart World, that was taken offline for unknown reasons. What Are Walmart’s Shared Value Networks? Shared Value

Beyond Extraction: Why Regenerative Business is the Only Way Forward

The RoundMap’s Regenerative Business Framework proposes a dual-cycle approach to business: one focused on value creation and another on impact. However, reality presents us with

From Profit to Purpose: How Shared Value Networks Unlock Long-Term Impact

Businesses today face a stark dilemma: how to balance short-term growth while pursuing long-term impact? It’s an especially relevant question in a competitive landscape where

RoundMap’s Flywheel of Shared Success: Leveraging Profit for Lasting Impact

Today’s business success can no longer be measured by short-term profits alone. Companies are called upon to take responsibility for their actions toward shareholders and

The Triad of Shared Value Networks: Shared Value Principles, Value Orchestration, and Network Orchestration

Building long-term, sustainable growth requires more than just orchestrating value or networks. While the Value Orchestration Lifecycle ensures the creation and adaptation of value, and

The End of Linear Thinking: Why Profit-First Models Can’t Sustain the Future

When businesses continue to operate under linear, profit-first models that prioritize short-term gains over long-term impact, several significant consequences arise, leading to systemic problems that

Ethical Prosperity: Navigating the Path to Sustainable and Equitable Growth

What does it mean to achieve prosperity in an ethical way? As leaders, we are often caught between the need to grow and the responsibility

Peter Drucker’s Most Profound Lesson Extended: Aligning Strengths Beyond Shareholder Value

Peter Drucker once stated that a leader’s most important role is to align strengths within an organization, making its weaknesses irrelevant. Indeed, focusing on the

The Paradox of Long-Term Growth: Why Short-Term Sacrifice is Essential for Meaningful Impact

A delicate balance of stakeholder interests is at the heart of any thriving company. Shareholders, customers, banks, employees, suppliers, and governments—all have their priorities. However,

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM