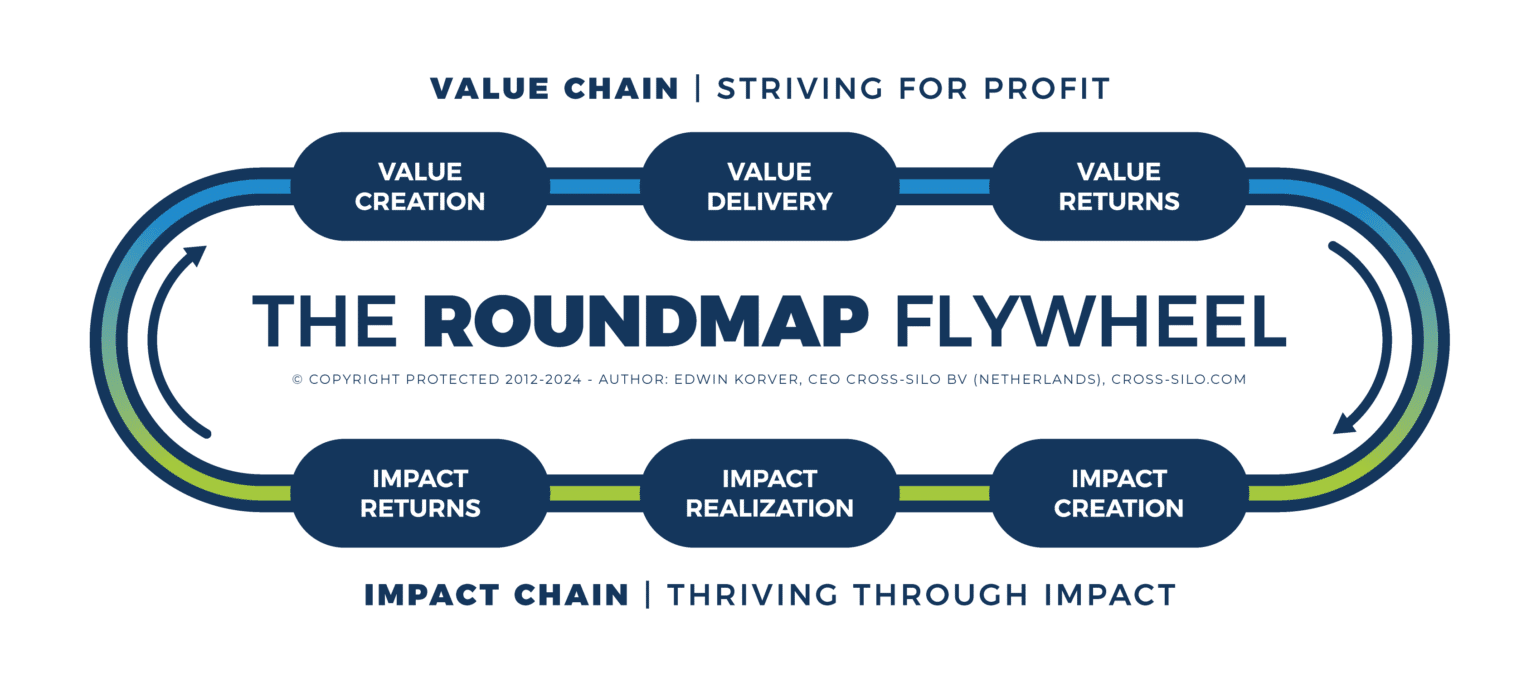

At the heart of the Flywheel of Shared Success lies the powerful interplay between Value Returns and Impact Returns, both of which operate on the principles of capturing, investing, giving back, and paying forward. These principles create a dynamic system where financial and social outcomes reinforce each other, driving sustainable growth and shared prosperity.

What Are Value Returns?

Value Returns represent what is captured through the Value Chain—profits, resources, and knowledge generated from delivering value to stakeholders. But Value Returns go beyond just capturing value; they embody the principle of paying forward. Businesses strategically reinvest a portion of their captured value into initiatives that amplify impact and mitigate adverse effects.

This pay-it-forward approach ensures that the resources generated by value creation are not solely consumed by the business but are redirected to create ripple effects of positive change, strengthening the broader ecosystem.

This dual meaning of returns transforms profits from an endpoint into a means of fostering shared prosperity. When businesses reinvest in their employees, communities, suppliers, and ecosystems, they create a foundation for long-term trust, loyalty, and innovation. In turn, these stakeholders contribute back to the business, amplifying its success in future cycles.

The Power of Value Returns:

- Financial Returns: Profits, resources, and knowledge captured from delivering value.

- Stakeholder Returns: The goodwill and trust gained by redistributing those profits equitably.

By embracing Value Returns, businesses align their financial goals with shared prosperity, demonstrating that doing well and doing good are mutually reinforcing.

What Are Impact Returns?

While Value Returns focus on paying forward, Impact Returns emphasize giving back. Impact Returns capture the tangible outcomes of amplified impact—measurable progress across people, planet, and profit—as well as the intangible benefits of goodwill, loyalty, and trust that flow back to the business.

By giving back to stakeholders and ecosystems—through initiatives like community investment, environmental restoration, or inclusivity efforts—businesses inspire reciprocal actions. Customers respond with loyalty, employees with engagement, and communities with support. These social drivers of giving back are as critical as the economic drivers of capturing and investing.

The Dual Meaning of Impact Returns:

- Return on Impact: The measurable outcomes of amplified impact on people, planet, and profit.

- Reciprocal Returns: The goodwill and engagement that stakeholders give back in response to purposeful actions.

Impact Returns complete the cycle, turning purpose into profit and profit into purpose. They demonstrate that when businesses amplify shared impact, they set the stage for future growth and resilience.

How Value and Impact Returns Work Together

The Flywheel of Shared Success operates on a blend of tangible and intangible returns, with both Value Returns and Impact Returns contributing to a self-reinforcing system:

Economic Drivers:

- Capturing Value: Generating profits, resources, and insights from value creation.

- Investing Value: Redirecting captured value into initiatives that amplify impact and mitigate harm.

Social Drivers:

- Giving Back: Building goodwill and trust by addressing stakeholder needs and driving positive outcomes.

- Paying Forward: Creating a ripple effect of shared prosperity by using resources to address systemic challenges and amplify impact.

Together, these drivers create a feedback loop where tangible results (profits and measurable impact) and intangible returns (loyalty, engagement, and trust) feed into one another, sustaining the cycle over the long term.

The Power of Reciprocity

The principles of giving back and paying forward are what make the Flywheel of Shared Success not just an economic model but a moral and relational one. By balancing economic goals with social responsibilities, businesses move beyond short-term self-interest to create ecosystems where everyone thrives.

- Value Returns ensure that the means captured through value creation are used to fuel systemic progress.

- Impact Returns demonstrate that the positive outcomes of impact amplification return to the business in the form of trust, loyalty, and resilience.

This reciprocity strengthens ecosystems, builds goodwill, and ultimately leads to greater long-term prosperity—for businesses, stakeholders, and society at large.

Why Returns Matter

The dual nature of returns—as outcomes and as reciprocity—goes to the heart of sustainable business. JUST Capital’s research shows that companies prioritizing shared prosperity outperform their peers, with their “100 Most JUST Companies” outperforming the Russell 1000 by 13.7%. This success is not coincidental; it’s a direct result of aligning financial outcomes with stakeholder needs and societal progress.

When businesses see returns not just as profits but as an opportunity to give back, they unlock a new kind of growth—one rooted in trust, collaboration, and mutual benefit.

Closing Thought

The Flywheel of Shared Success is not just about capturing what we can—it’s about amplifying what we give. By embracing the principles of giving back and paying forward, alongside capturing and investing, businesses can unlock a model of sustainable growth where financial and social outcomes reinforce each other. It’s not just about doing well; it’s about doing well together.

Continue Reading on Striving & Thriving:

More Than Crumbs: The Case for True Value Creation

For decades, shareholder primacy has dictated corporate decision-making, driving businesses to prioritize short-term profits and disproportionate returns to shareholders over long-term sustainability and stakeholder value.

Beyond Extraction: Why Regenerative Business is the Only Way Forward

The RoundMap’s Regenerative Business Framework proposes a dual-cycle approach to business: one focused on value creation and another on impact. However, reality presents us with

RoundMap Regenerative Business Framework: Empowering the Present while Building the Future

Executive Summary The Regenerative Business Framework addresses the critical need for businesses to move beyond mere profitability toward regenerative practices that drive long-term growth and

Rethinking the Flywheel: Why Amazon’s Misinterpretation Misses the Mark

The concept of a flywheel, as originally designed, was never about spinning faster to achieve exponential growth. It was about stabilizing energy output—ensuring a steady,

From Striving to Thriving: How Amazon is a Strive-Driven Giant Failing to Thrive

Amazon has become synonymous with business success, often hailed as a master of efficiency, customer obsession, and innovation. At the heart of its growth strategy

The Flywheel of Shared Success: How Impact Drives Sustainable Growth

In the fast-paced world of business, the focus often rests on immediate value creation—developing products, closing deals, and driving revenue. While these activities generate vital

The Reciprocity Effect: How Giving Back Completes the Cycle

Ten years ago, I began developing the Customer Lifecycle—a map of frontline activities—because I saw how social media was reshaping the marketplace. It wasn’t just

Impact Strategies to Amplify Value and Mitigate Harm Across Stakeholders

What if doing the right thing wasn’t just a moral choice but a strategic one? What if amplifying your organization’s positive impact while mitigating harm

From Extraction to Contribution: Thriving Together with Shared Success

The Flywheel of Shared Success is designed to demonstrate that staying within the boundaries of responsible growth doesn’t mean limiting our ambitions—it means channeling them

From Hopping for Cash to Building Bridges: Why Self-Interest Alone Can’t Sustain Shared Prosperity

What we’re proposing with the Flywheel of Shared Success is nothing short of a call to confront and correct our deeply flawed execution of Adam

If Adam Smith would still be alive, how would he perceive our modern economic systems?

If Adam Smith were to assess the state of our modern economic systems, his critique would likely be sharp yet eloquent, reflecting the moral gravitas

The Impact Chain Framework: Transforming Values into Shared Success

The Impact Chain operates alongside the Value Chain, complementing its focus on value creation and economic profit. While the Value Chain transforms activities into financial

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM