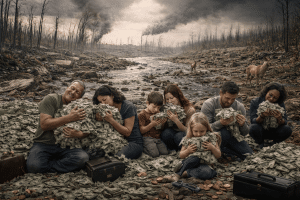

After years of studying the intricate dynamics of business, one conclusion stands clear: to regain their constructive role in society, companies must undergo a fundamental shift. We’ve seen the rise of profit-centric models that focus on short-term gains, often at the expense of the long-term well-being of our communities, environment, and future. This approach has led to financialization—where profit dominates decision-making, externalizing the costs of adverse effects onto society and nature.

But if we are to thrive, businesses must evolve. Resilience, adaptability, and long-term success are no longer driven by isolated financial metrics but by the alignment of purpose, impact, and collaboration.

Purpose Isn't Enough—It Must Lead to Impact

At the core of this transformation is purpose, yet purpose alone is insufficient. Every organization needs to align its strengths with its purpose, but purpose must drive meaningful impact. And that impact cannot be achieved in isolation. It requires collaboration across functions, companies, and industries. We need to amplify the positive impact we wish to create and mitigate the adverse effects of our actions. This is where the concept of shared value networks comes in—aligning our impact with that of others to create collective, amplified value.

Breaking the Chains of Corporate Isolationism

Corporate isolationism, where companies operate as islands in pursuit of their own goals, is a relic of a past that cannot support the future. Cross-company alignment is essential. The problems we face today—climate change, inequality, resource depletion—are too vast for any one entity to tackle alone. Businesses must collaborate not just across internal functions but externally as well, forming alliances rooted in shared values that extend beyond the interests of a single shareholder.

Beyond the Balance Sheet: The Need for Equitable Businesses

To build more equitable businesses, profit cannot be the sole driver of our actions. Wise decision-making requires engaging all stakeholders—employees, communities, customers, and the environment. In an ideal world, organizations would be led by cross-stakeholder boards, where every voice has a say in shaping the future. While legal frameworks may not yet fully support this, we can move toward building shared value networks that manifest these stakeholder interests and drive the right kinds of outcomes.

From Customer Success to Significance

Another fundamental shift is from simply fulfilling immediate customer needs to driving significance. It’s not enough to help customers complete the task at hand; we need to help them succeed in a way that aligns with their broader goals, aspirations, and futures. This is the essence of significance. True customer success happens when we can achieve results and contribute to the long-term success and purpose of those we serve.

A Blueprint for the Future: Impact Plans Over Business Plans

This thinking has led us to a critical conclusion: Businesses should no longer be solely focused on their strategic plans; they must create impact plans. An impact plan asks: What is the long-term change we want to see? How do we ensure that our actions create value not only for shareholders but also for society, the environment, and the broader ecosystem? The impact must be our highest goal; collaboration is essential to achieve it.

A Call to Action: Building Impact-Driven Ecosystems

As we look to the future, businesses must move past fulfilling short-term needs and start planning for lasting impact. We are all value actors in a larger ecosystem, and the driving force behind future ecosystems must amplify positive impacts and mitigate adverse effects.

We are not just talking about collaboration here—we are talking about forming alliances, shared value networks, and partnerships that prioritize impact over profit and long-term well-being over short-term gain. The blueprint for future generations is clear: businesses must realign internally and externally to drive amplified impact. Only then can we fulfill our role as genuine contributors to society, building not just for profit but for the future.

Continue Reading:

Governing Value: From Extraction to Accountability in Living Systems

Why Capitalism Struggles with the Laws of Nature Economic theories such as Donut Economics, Earth Overshoot Day, and planetary boundary frameworks have made one thing

The Power of Three: Structuring Shared Value Regeneration

Beyond Value Creation In today’s dominant business paradigm, customer value creation is often held up as the gold standard of success. Yet beneath the surface,

Mapping the Future: We’re Writing the Book on RoundMap®

At RoundMap®, we believe the future of business lies in wholeness, not fragmentation. For too long, organizations have been shaped by linear thinking, short-term gains,

More Than Crumbs: The Case for True Value Creation

For decades, shareholder primacy has dictated corporate decision-making, driving businesses to prioritize short-term profits and disproportionate returns to shareholders over long-term sustainability and stakeholder value.

Beyond Extraction: Why Regenerative Business is the Only Way Forward

The RoundMap’s Regenerative Business Framework proposes a dual-cycle approach to business: one focused on value creation and another on impact. However, reality presents us with

RoundMap Regenerative Business Framework: Empowering the Present while Building the Future

Executive Summary The Regenerative Business Framework addresses the critical need for businesses to move beyond mere profitability toward regenerative practices that drive long-term growth and

The RoundMap Flywheel: A Shift Toward Sustainable Ecosystem Resilience

What if impact creation was as strategic and intentional as value creation? What if every dollar earned didn’t just fuel a business’s bottom line but

From Striving to Thriving: How Amazon is a Strive-Driven Giant Failing to Thrive

Amazon has become synonymous with business success, often hailed as a master of efficiency, customer obsession, and innovation. At the heart of its growth strategy

Impact Strategies to Amplify Value and Mitigate Harm Across Stakeholders

What if doing the right thing wasn’t just a moral choice but a strategic one? What if amplifying your organization’s positive impact while mitigating harm

From Extraction to Contribution: Thriving Together with Shared Success

The Flywheel of Shared Success is designed to demonstrate that staying within the boundaries of responsible growth doesn’t mean limiting our ambitions—it means channeling them

The Twin Engines of Progress: Returns on Value and Impact

At the heart of the Flywheel of Shared Success lies the powerful interplay between Value Returns and Impact Returns, both of which operate on the

From Hopping for Cash to Building Bridges: Why Self-Interest Alone Can’t Sustain Shared Prosperity

What we’re proposing with the Flywheel of Shared Success is nothing short of a call to confront and correct our deeply flawed execution of Adam

Author

-

Edwin Korver is a polymath celebrated for his mastery of systems thinking and integral philosophy, particularly in intricate business transformations. His company, CROSS/SILO, embodies his unwavering belief in the interdependence of stakeholders and the pivotal role of value creation in fostering growth, complemented by the power of storytelling to convey that value. Edwin pioneered the RoundMap®, an all-encompassing business framework. He envisions a future where business harmonizes profit with compassion, common sense, and EQuitability, a vision he explores further in his forthcoming book, "Leading from the Whole."

View all posts Creator of RoundMap® | CEO, CROSS-SILO.COM