Executive Summary

This is a company-internal document. Please consider this information confidential.

SVN-as-a-Service is a new business model that proactively identifies and connects organizations with shared impact goals to forge strategic partnerships. Independent Regenerative Business Consultants initiate this process by mapping businesses’ long-term impact objectives and product lifecycle challenges.

Through careful partner matching and professional facilitation, they help create Shared Value Networks (SVN) that:

- Accelerate impact goal achievement

- Share development risks and costs

- Enable responsible product lifecycle management

- Create lasting shared value (CSV) throughout the ecosystem

Our approach reduces the complexity and uncertainty of building transformative partnerships while protecting long-term investments from short-term pressures. By taking the initiative in network formation and facilitation, we help businesses achieve deeper impact sooner and more effectively than they could alone.

Introduction

Nature teaches us a fundamental truth: survival depends on regeneration and adaptation. Each new generation must evolve to meet changing conditions, with only the most adaptable (fittest) thriving. This principle equally applies to business longevity. Yet, most businesses focus solely on profit maximization while ignoring ecosystem health. They extract value from stakeholders, communities, and the environment without reinvesting in their regeneration. Without nurturing the conditions that enable long-term success, they typically decline within 10-15 years.

The venture capital model accelerates this decline, as argued by Dr. Melanie Rieback. By prioritizing rapid growth and early exits, it encourages businesses to aggressively exploit markets while ignoring the foundations of longevity: responsible growth, equitable value distribution, and ecosystem resilience. To maximize short-term profits, companies externalize costs onto stakeholders, damaging the broader ecosystem that sustains them. We see this pattern repeatedly: VC-backed ventures collapse post-exit, leaving environmental and social damage in their wake. Abandoned bikes litter cities, windmill blades decay in deserts, and microplastics infiltrate our food chain – all casualties of extractive thinking.

Building truly regenerative businesses requires a fundamental shift. We must design for both present value creation and future sustainability, ensuring fair distribution of benefits while taking full responsibility for our impact on stakeholders, communities, and the environment.

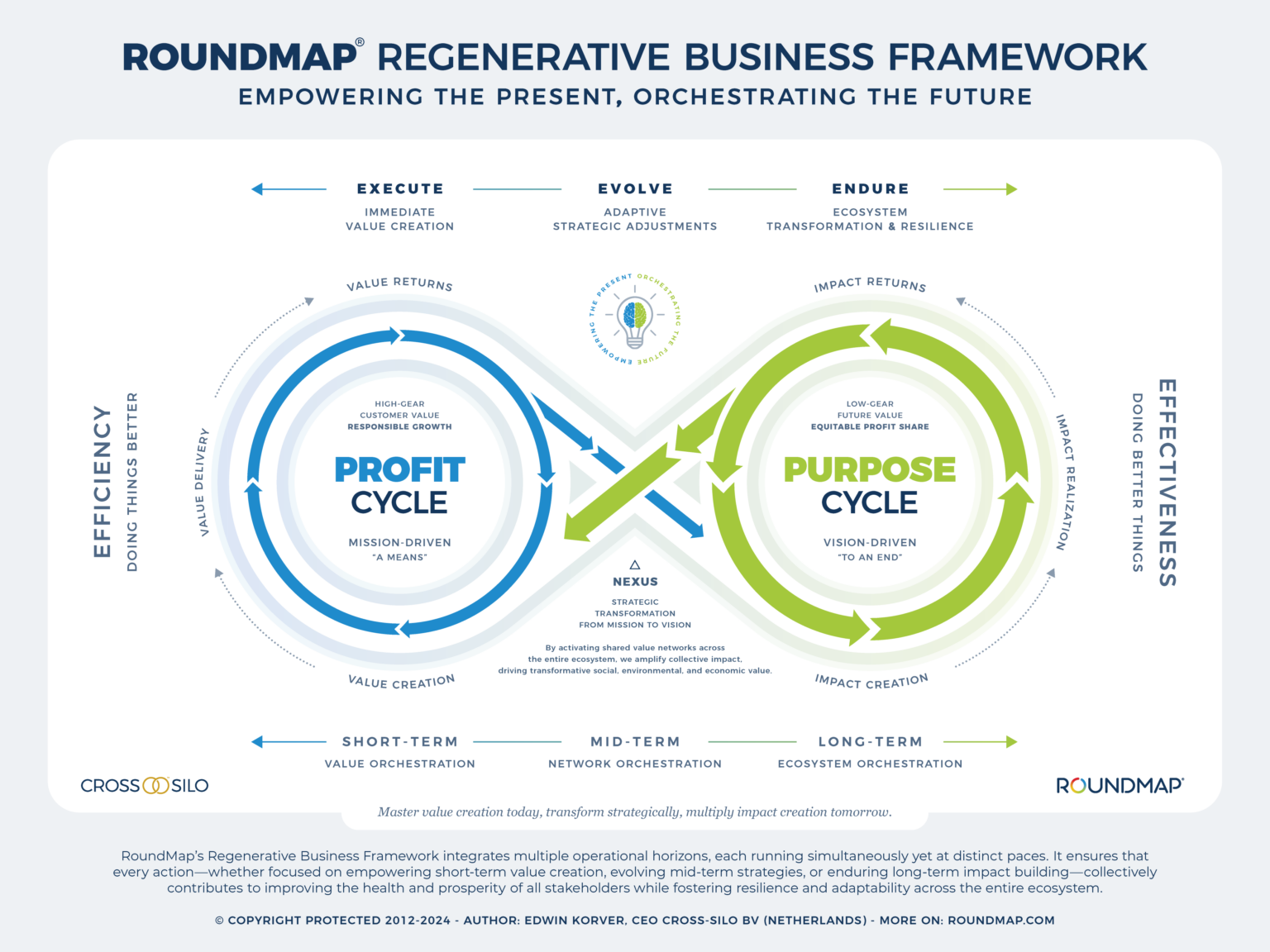

Regenerative Business Framework

Our regenerative business framework operates on two parallel cycles. The Profit Cycle runs in high-gear, optimized for immediate value creation to satify current needs. The Purpose Cycle operates in low-gear, dedicated to strategic reinvestments to strengthen the ecosystem’s health and stakeholder prosperity.

When asked, many organizations claim they can’t afford to prioritize long-term, low-gear operations – they’re under too much pressure to deliver immediate returns. But the evidence is clear and compelling: companies focused solely on short-term gains are increasingly vulnerable. In a world of rapid change and mounting societal challenges, those who fail to invest in ecosystem development and future capacity find themselves disrupted by more adaptable competitors. The real risk isn’t in making these investments – it’s in failing to make them.

We also recognize the practical challenges. Most organizations aren’t structured or resourced to operate at two different speeds simultaneously. Even those that understand the importance of both cycles struggle with the reality of managing them. Think of it like a four-wheel drive vehicle: you must choose between low or high gear depending on the terrain—you can’t engage both modes simultaneously. This raises a critical question: How can businesses build future resilience while maintaining their operational focus on current value creation?

The answer, we believe, lies in shared value networks (SVNs). These networks act as intermediate organs that allow businesses to maintain their operational focus while participating in broader impact initiatives. This is particularly significant given that most organizations already struggle with internal functional silos and stratification. Building effective shared value networks requires not only breaking down these internal barriers but also crossing organizational boundaries to create collaborative ecosystems that can drive systemic change.

Business Model Innovation

This challenge led us toward a new business model. By offering shared value networks as-a-service, or SVN-as-a-Service, we’re aiming to create an “impact infrastructure” that allows companies to participate in long-term value creation without having to fundamentally restructure their internal operations or bridge the widespread internal and external divides.

The advantages of this approach include:

- Companies can maintain their operational efficiency while still participating in impact creation

- The shared network spreads the costs and risks of low-gear activities across multiple participants

- Professional facilitation of these networks increases their effectiveness and sustainability

- Companies can scale their impact involvement based on their capacity and readiness

- The network effect multiplies the impact potential beyond what any single organization could achieve

It’s like creating a specialized “transmission system” that allows organizations to engage in low-gear activities through the network while maintaining their high-gear internal operations. This solves the practical challenges of dual-pacing while still achieving the desired impact outcomes.

In short, our regenerative business model can be described as:

The SVN-as-a-Service business model proactively identifies opportunities for impact amplification and mitigation by forging, facilitating, and growing shared value networks across ecosystem participants. By enhancing future value creation and ecosystem resilience, it generates impact returns that strengthen immediate mission-driven operations, creating a flywheel effect that accelerates both value creation and impact over time.

In other words, SVN-as-a-Service:

- Builds momentum through network effects

- Converts shared investments into accelerating returns

- Creates compounding benefits across the ecosystem

- Amplifies impact with each cycle

- Generates increasing force for transformation

SVN-as-a-Service isn’t just about sustaining operations or creating linear growth – it’s about creating exponential acceleration in both value and impact. This is a powerful way to convince shareholders that long-term ecosystem investments actually enhance rather than compete with short-term value creation.

Business Model Options

Let’s break down potential business models for offering shared value networks (SVN) as-a-service:

Consulting Model:

- Advisory services to help companies identify and join existing SVNs

- Facilitation of network formation and stakeholder engagement

- Impact measurement and reporting services

- Strategic guidance on balancing high-gear operations with network participation

- Training and capability building for effective network collaboration

Platform Model:

- Digital platform connecting potential network participants

- Tools for managing shared resources and projects

- Impact tracking and measurement systems

- Collaboration and communication infrastructure

- Matchmaking between complementary organizations

- Automated reporting and analytics

Hybrid/Ecosystem Model:

- Core platform infrastructure for network management

- Consulting services for complex network formation

- Knowledge sharing and best practices community

- Facilitated innovation spaces

- Impact investment coordination

- Training and certification programs

- Network governance support

Each model has different revenue streams, scaling potential, and value propositions.

Revenue Model Options

Let’s analyze each model’s key aspects:

| Aspects | Consulting Model | Platform Model | Hybrid/Ecosystem Model |

|---|---|---|---|

| Revenue Streams | Project fees, retainers, success fees tied to impact metrics | Subscription fees, transaction fees, premium features | Mix of platform fees, consulting, training, facilitation |

| Scaling Potential | Highly dependent on expert knowledge and time | High scalability once platform is established | Balanced growth through multiple channels |

| Value Proposition | Deep expertise, customized solutions, hands-on facilitation | Efficient matching, standardized tools, broad reach | Comprehensive solution combining tech and expertise |

| Key Resources | Expert consultants, methodologies, relationship networks | Technology platform, user base, data analytics | Platform, experts, methodology, community |

| Market Entry | Easier to start, lower initial investment | Higher initial investment, needs critical mass | Phased approach possible, starting with consulting |

| Risk Profile | Lower financial risk, higher reputation dependency | Higher upfront risk, potential for strong returns at scale | Diversified risk through multiple service lines |

SVN-as-a-Service in Action

Imagine MetalTech, a medium-sized manufacturer of precision metal components. While profitable, they generate significant metal waste and have committed to achieving zero waste by 2030. However, they lack the expertise and networks to make this happen while maintaining their operational focus.

This is where SVN-as-a-Service comes in. Our liaison first maps the potential for shared value creation:

- Local universities with materials science departments researching innovative recycling methods

- A startup developing AI-powered waste sorting technology

- Three smaller manufacturers in adjacent industries that could use MetalTech’s waste as raw material

- A logistics company specializing in sustainable transport

- A regional innovation hub focused on circular economy initiatives

The liaison then orchestrates the network:

- Facilitates introductions and builds trust between participants

- Helps identify specific shared value opportunities

- Coordinates pilot projects to prove the concept

- Establishes governance structures for long-term collaboration

- Measures and communicates impact to all stakeholders

The result? MetalTech maintains its operational focus while:

- Reducing waste disposal costs

- Creating new revenue streams from “waste” materials

- Accelerating innovation through university partnerships

- Building resilient supply chain relationships

- Amplifying their environmental impact through the network

- Gaining valuable insights from cross-industry collaboration

“Companies have overlooked opportunities to meet fundamental societal needs and misunderstood how societal harms and weaknesses affect value chains. Our field of vision has simply been too narrow.”

Prof. Michael Porter on Creating Shared Value

Three Modes: Mission, Strategy, and Vision

Considering the image above, an organization has to act across three operating modes (or paces):

1. Mission-Driven Profit Cycle (Short Term)

Operating Mode:

- Immediate execution and delivery

- Clear customer needs fulfillment

- Established processes and capabilities

- Measurable quarterly results

- Focuses on ‘doing things better’

Challenges:

- External financial pressures (shareholders, banks)

- Market/analyst expectations

- Cost externalization (environmental, social, quality)

- Resource depletion

- Short-term profit focus

2. Strategy-Driven Nexus (Medium Term)

Operating Mode:

- Links action to vision

- Transforms capabilities

- Balances resources

- Orchestrates transitions

Challenges:

- Investment uncertainty

- Strategy disruption risk

- Fund reallocation threats

- Momentum maintenance

- Initiative fragmentation

- Competitive positioning risk

3. Vision-Driven Purpose Cycle (Long Term)

Operating Mode:

- Future state shaping

- New capability building

- Market creation

- Ecosystem transformation

- Focuses on ‘doing better things’

Challenges:

- Limited funding (low priority)

- Shareholder resistance

- Investment protection

- ROI pressure

- Timeframe misalignment

- Resource reallocation risk

This three-mode operating model helps explain why organizations struggle – they’re not just balancing two competing cycles, but orchestrating a complex interplay between current execution, strategic transformation, and future creation. The strategy layer isn’t just a middle ground – it’s the active orchestrator that ensures the organization can deliver today while building for tomorrow.

Benefits of Shared Value Networks

Shared Value Networks can help mitigate mid- and long-term investment uncertainty by distributing costs among ecosystem partners to reduce individual investment risk. By creating mutual stakes and shared commitment while leveraging collective wisdom and capabilities, partners accelerate innovation and amplify impact far beyond what they could achieve alone. As the network strengthens, it creates a flywheel effect that generates increasing returns – from waste reduction and operational efficiencies in the short term to breakthrough innovations and ecosystem resilience in the long term. This makes strategic transformation not just more sustainable but self-reinforcing, as the combined strength of the network protects long-term initiatives from individual partner pressures while accelerating value creation for all participants.

Hence, SVNs can help create long-term value by:

- Distributing costs among ecosystem partners

- Reducing individual investment risk

- Creating mutual stakes in long-term success

- Building resilient capabilities across partners

- Leveraging combined resources for strategic initiatives

- Protecting investments through shared commitment

Overall, Shared Value Networks offer dual benefits:

Strategic Advantages:

- Collective wisdom and expertise

- Shared R&D capabilities

- Combined market access

- Distributed innovation capacity

- Accelerated learning

- Risk/resource sharing

Operational Benefits:

- Waste reduction through partner synergies

- Optimized resource utilization

- Reduced environmental impact

- Enhanced supply chain efficiency

- Shared infrastructure

- Improved quality through collaboration

Together, these qualities enable organizations to build resilient futures while improving current operations, making SVNs powerful tools for both short-term optimization and long-term transformation.

Core Marketing Plan Components

We’ve created a marketing plan for our Shared Value Network (SVN) as a service offering. Let’s break this down into clear components based on a hybrid approach starting with independent consultants.

1. White Paper Development

- Focus on the business case for SVNs, including their role in creating sustainable value through education, innovation, and ecosystem resilience

- Include research-backed evidence of long-term value creation and potential for exponential growth

- Outline the flywheel effect: how networks create compounding value over time

- Present case studies or theoretical models showing successful SVN implementations

2. Consultant Recruitment & Enablement

- Create a consultant onboarding package including:

- SVN methodology and best practices

- Value proposition for potential clients

- Network facilitation guidelines

- Success metrics and KPIs

- Compensation structure and partnership terms

3. Client-Facing Materials

- Develop an explainer video showcasing:

- The SVN concept and benefits

- How the SVN-as-a-Service works

- Success stories and testimonials (once available)

- Value proposition for participants

4. Research & Validation

- Compile existing research on:

- Network effects in business ecosystems

- Long-term value creation through collaboration

- Impact measurement frameworks

- Success factors in sustainable business networks

Case Study: DSM

The multinational, DSM-Firmenich (a global leader in health, nutrition, and bioscience combined with the world’s largest privately-owned fragrance and taste company) deployed Creating Shared Value (CSV) as a business strategy after recognizing that it faced the same key challenges as its stakeholders, particularly around climate change, energy needs, and improving health and wellness for a growing global population.

The company saw an opportunity to create sustainable value through innovations that would help customers provide better solutions while serving “People, Planet and Profit.” According to Jos Haastrecht, the impact of this strategy reaches across different stakeholder groups:

- Customers receive more sustainable, longer-lasting, safer, healthier, and more nutritious alternatives, allowing them to offer improved and differentiated products to their end-users. This includes innovations like lighter, safer materials for automotive manufacturing.

- NGOs and governments derive value from DSM’s solutions that benefit society and the environment, including partnerships like the one with UN World Food Programme to combat malnutrition.

- Employees experience increased engagement and motivation through contributing to societal improvement and feel connected to the company’s success in making positive impact.

- Shareholders benefit from stronger growth and profitability resulting from the CSV strategy.

- In materials science, they develop lighter, safer, stronger, and more durable materials with lower environmental footprints throughout value chains, with specific applications in the automotive industry reducing fuel consumption and improving safety.

- Their nutrition solutions, implemented through a partnership with UN World Food Programme since 2007, provide essential vitamins, nutrients, and fortified rice, focusing on vulnerable populations in countries like Nepal, Kenya, Bangladesh, and Afghanistan.

- The company has also developed their People+ Approach, which includes metrics to measure impact on consumers, workers, and communities. This uses the “DSM People Life Cycle Analysis” to assess products’ impact on health, comfort, and well-being, and transforms supplier and customer relationships into co-creation partnerships.

The effectiveness of this strategy is demonstrated through DSM’s ability to measure positive outcomes through regular stakeholder perception surveys, media coverage metrics, and digital channel engagement analytics.

Continue Reading:

Governing Value: From Extraction to Accountability in Living Systems

Why Capitalism Struggles with the Laws of Nature Economic theories such as Donut Economics, Earth Overshoot Day, and planetary boundary frameworks have made one thing

The Power of Three: Structuring Shared Value Regeneration

Beyond Value Creation In today’s dominant business paradigm, customer value creation is often held up as the gold standard of success. Yet beneath the surface,

Mapping the Future: We’re Writing the Book on RoundMap®

At RoundMap®, we believe the future of business lies in wholeness, not fragmentation. For too long, organizations have been shaped by linear thinking, short-term gains,

More Than Crumbs: The Case for True Value Creation

For decades, shareholder primacy has dictated corporate decision-making, driving businesses to prioritize short-term profits and disproportionate returns to shareholders over long-term sustainability and stakeholder value.

Beyond Extraction: Why Regenerative Business is the Only Way Forward

The RoundMap’s Regenerative Business Framework proposes a dual-cycle approach to business: one focused on value creation and another on impact. However, reality presents us with

RoundMap Regenerative Business Framework: Empowering the Present while Building the Future

Executive Summary The Regenerative Business Framework addresses the critical need for businesses to move beyond mere profitability toward regenerative practices that drive long-term growth and

The RoundMap Flywheel: A Shift Toward Sustainable Ecosystem Resilience

What if impact creation was as strategic and intentional as value creation? What if every dollar earned didn’t just fuel a business’s bottom line but

From Striving to Thriving: How Amazon is a Strive-Driven Giant Failing to Thrive

Amazon has become synonymous with business success, often hailed as a master of efficiency, customer obsession, and innovation. At the heart of its growth strategy

Impact Strategies to Amplify Value and Mitigate Harm Across Stakeholders

What if doing the right thing wasn’t just a moral choice but a strategic one? What if amplifying your organization’s positive impact while mitigating harm

From Extraction to Contribution: Thriving Together with Shared Success

The Flywheel of Shared Success is designed to demonstrate that staying within the boundaries of responsible growth doesn’t mean limiting our ambitions—it means channeling them

The Twin Engines of Progress: Returns on Value and Impact

At the heart of the Flywheel of Shared Success lies the powerful interplay between Value Returns and Impact Returns, both of which operate on the

From Hopping for Cash to Building Bridges: Why Self-Interest Alone Can’t Sustain Shared Prosperity

What we’re proposing with the Flywheel of Shared Success is nothing short of a call to confront and correct our deeply flawed execution of Adam